Are debit cards safe to use online? A guide to risks and safety tips

Debit cards are a relatively safe way to pay online as long as you’re sticking to reputable merchants and trustworthy websites. However, they come with certain risks: since the cards are linked to your bank account, any fraudulent transaction directly affects your funds. Unlike credit cards which typically offer stronger protections and easier dispute processes, debit cards have limited support for disputing unauthorized charges and recovering lost funds after fraud.

The risks of using debit cards for online purchases

Debit cards are like a key to your checking account. When you pay with one, you’re allowing a merchant to pull the authorized purchase amount directly from your balance. Even though debit cards typically require a PIN or a signature to authorize transactions, someone who gets access to your card details (or the card itself) can still exploit your funds through online purchases or unauthorized withdrawals as long as the card remains active.

Credit cards, on the other hand, let you “borrow” money from a card issuer, so purchases made with a credit card don’t affect your balance directly. If someone gets your credit card number, they won’t be spending your actual money. They’ll be spending the card issuer’s money that’s (presumably) being loaned to you.

So, is it safe to use a debit card online? The answer depends on how you use it. It’s generally not the safest payment option and comes with the following risks:

- Fraud protection is limited. As opposed to credit cards, where you typically benefit from the company’s zero liability policy for unauthorized charges, debit cards have very strict reporting requirements. Moreover, depending on how consumer-friendly your banking institution is and how quickly you report fraud, you might not get all your money back.

- Your funds are impacted immediately. If fraud occurs when you’re using a debit card online, the money is withdrawn directly from your bank account and may not be immediately recoverable. Credit card fraud, however, affects your credit limit—not your actual bank balance—which gives you more time and protection during the dispute process.

- There’s limited support for disputes and chargebacks. Credit card and debit card disputes are regulated by different federal laws (the Fair Credit Billing Act and the Electronic Fund Transfer Act, respectively). Both laws protect consumers against fraud, but the FCBA’s reporting requirements and liability limits are more lenient.

- Fund recovery may take a lot of time. Disputing fraudulent charges may take days, even weeks, during which time the stolen funds are unavailable. This can affect your ability to pay bills and other essentials, as well as disrupt recurring payments linked to your balance.

- You’ll face greater exposure if your debit card data is stolen. Whether your card info is compromised through phishing on the internet or through a skimming device, all the funds in the account associated with that card are at risk.

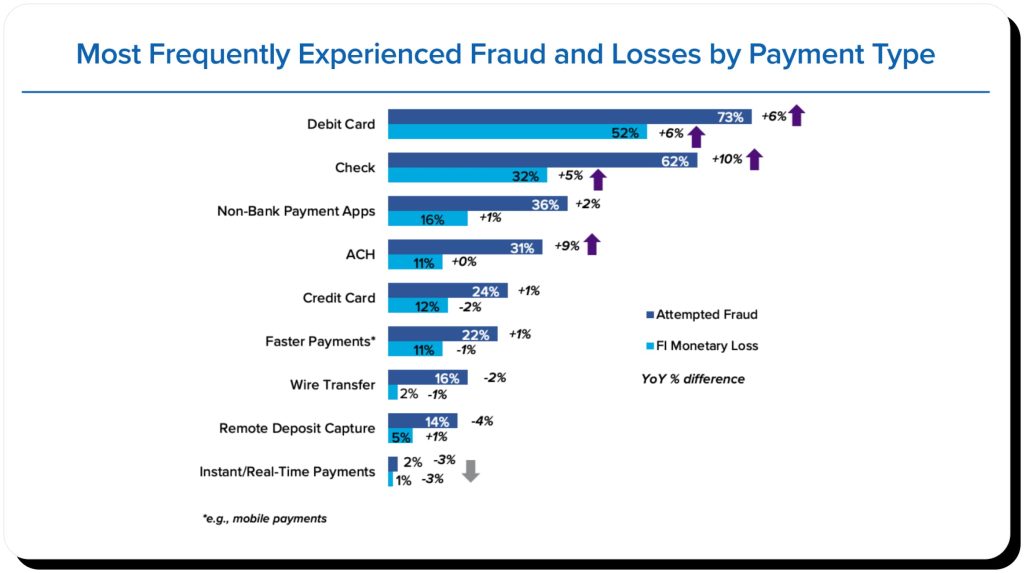

In fact, the Federal Reserve Financial Services survey revealed that the top payment type for fraud attempts last year was debit cards. Additionally, debit card fraud caused the most monetary losses to financial institutions surveyed.

When is paying online with a debit card safe?

While using a debit card online comes with risks, it can be relatively safe in the following cases:

On secure websites

If a website is encrypted with HTTPS, your data is protected from compromise through man-in-the-middle (MITM) attacks. Reputable platforms are also PCI compliant, meaning they follow strict standards to securely process, transmit, and store payment information to prevent unauthorized access or data breaches.

For low-risk purchases

Low-risk purchases are small transactions with a low potential for negative consequences and minimal financial loss in case something goes wrong. Small amounts are typically easier and faster to recover, and your funds are less likely to be fully drained.

You use temporary debit card numbers

Some banks and fintech apps allow you to use virtual or one-time card numbers that act as a substitute for your real card. These temporary numbers are easy to generate and replace, making them ideal for online purchases. While the money comes directly from your balance, your actual debit card number and other sensitive information aren’t exposed in case you encounter scams.

You have payment authentication enabled

If you enable payment authentication, every transaction will require verification through a code, fingerprint, Face ID, or other secure method. This extra step helps prevent unauthorized charges and lets you block suspicious transactions before they’re finalized.

Safer alternatives to debit cards for online payments

Debit cards are by far not the safest option to pay online—there are much better alternatives:

- Credit cards. If unauthorized purchases are made using your credit card, you’re not liable in most cases and the disputed funds don’t affect your actual balance during resolution. Moreover, credit cards typically offer stronger fraud protection.

- Virtual cards. One-time card numbers are an easy way to enjoy the convenience of a debit card without exposing your real card number or other PII. If the virtual card number gets compromised, you can just dump it and get another one.

- Prepaid debit cards. Using a card with only a small amount of money on it ensures that any loss you experience is limited to just that amount. Keep in mind, however, that these cards may come with fees—such as activation, reloading, or monthly maintenance charges—that can reduce their overall value.

- Digital wallets. A service like PayPal, Google Pay, and Apple Pay is highly secure, as it protects your card data with tokenization and encryption. They also often require payment authentication to reduce the risk of unauthorized transactions even if your device is compromised.

How to protect your debit card when shopping online

If your go-to payment method online is a debit card, then you want to stick to the following best practices to keep your information safe:

- Pay only on trusted sites. Avoid sharing your card information on unfamiliar and unsecured platforms. Also, always check the site’s URL—scammers build highly convincing pages that look like legit platforms, but there will be a misspelling in the URL or no HTTPS.

- Enable payment authentication. Set up identity verification for every transaction to make sure that no unauthorized purchases are made behind your back.

- Enable transaction alerts. Set up notifications either for every transaction or for when it exceeds a specific amount. Depending on the amount, you might get a lot of alerts, but on the other hand, you’ll be able to keep a very close eye on things.

- Enable spending limits. To prevent scammers from going on a spending spree in case they get access to your card details, place a cap on the amount that your debit card can be used for in a day.

- Don’t save your card information on websites. While it can save a little bit of time during checkout, saving card details increases your risk of exposure. Even reputable platforms aren’t completely immune to cyberattacks—the Ticketmaster data breach being a good example. It’s better to paste the information manually each time.

- Avoid public Wi-Fi for transactions. MITM attacks typically work by intercepting network traffic, which is much easier to do on unsecured public Wi-Fi networks. You might not even be aware that your payment details are being spied on by a hacker.

- Regularly monitor your bank statements for suspicious activity. Frequently check your transaction history to detect unauthorized payments early on. Debit cards have limited reporting timeframes, and noticing fraud early is crucial to recovering your funds.

- Consider creating multiple checking accounts. You can separate out your checking accounts so that there’s one for important transactions like bills and another one for online shopping.

How Onerep makes your online shopping experience safer

If someone gets ahold of your debit card information, there’s no telling where that data might go. Combined with your legal name, billing address, phone number, and other sensitive details, it’s a gateway to your finances and even identity.

Unfortunately, your sensitive information isn’t that difficult to find online—data brokers make it easily available to anyone interested. These sites aggregate your details from various public sources, then combine them into personal reports that reveal a whole lot about you, often for free. Moreover, broker sites don’t control or track who researches you, which is widely abused by scammers and other malicious actors looking to impersonate you, target you with a phishing attack, take over your accounts, or even steal your identity.

Onerep helps you safeguard your personal information by removing it from 232 data broker sites. The service scans the brokers and finds the exact pages that expose your sensitive details, then sends removal requests on your behalf. As data brokers frequently update their databases and publish new profiles, Onerep continuously reruns scans to make sure your information stays off.

By removing you from data broker sites, Onerep greatly reduces the risk of you being targeted with scams, phishing, financial fraud, and other threats.

FAQs

Should I use my debit card online?

If you’re certain that you’re shopping on legitimate and secure websites, it’s relatively safe to use your debit card. However, there are much safer ways to pay, including a credit card or a digital wallet.

Is it safer to shop with a credit card?

Yes, it’s safer to use a credit card than a debit card online. This is because a debit card takes money straight from your account balance, whereas a credit card uses money lent to you by the card issuer. Credit cards also typically have stronger fraud protections and more lenient dispute processes.

What should I do if my debit card info is stolen online?

If your debit card number is stolen, immediately contact your bank and report the issue. Most likely, they’ll block or cancel the card and start the process of sending you a new one. You should also monitor your account for further suspicious activity, update login credentials, and enable transaction alerts to catch unauthorized activity.

Can someone hack my bank account with my debit card number?

Usually, a debit card number alone isn’t enough for someone to break into your bank account. However, if a hacker has other information, such as your address, expiration date or PIN, they’ll be able to make online purchases.

Is it safe to order online with a debit card?

As long as you order from a reputable platform, it’s relatively safe to order with a debit card. However, make sure you don’t save card information on the website and complete the checkout as a guest if possible to prevent your data from being stored.

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.