CoreLogic (Cotality) opt out guide for quick removal in 2025

| Removal difficulty: | High |

| Manual submission: | around 30 min |

What is CoreLogic?

CoreLogic, now rebranded as Cotality, is a corporation offering data solutions to the property industry. According to their website, they “bring together technology, data, and expertise to create a rich view of the property ecosystem.”

Simply put, Cotality provides real estate agents, lenders, insurance companies, homeowners, and other professionals with insights on property value, location history, damage reports, climate risks, tax transactions, and more–helping them determine trends, opportunities, and risks.

How to opt out of CoreLogic (Cotality)

In short:

- Only California residents have CoreLogic opt out options

- Eligible individuals are HR Data Subjects (job applicants/employees/contractors) and B2B Data Subjects (business-related contacts)

- HR Data Subjects: fill out the HR Data Subject Request Form cotality.com/employee-applicant-privacy-form

- B2B Data Subjects: use the B2B Data Subject Request Form cotality.com/legal/b2b-client-privacy-form

- Alternatively, call 1-800-634-4149

- For Credco (credit reports) concerns, call (800) 637-2422 or mail them

At the moment, the company doesn’t really disclose to individuals what data it stores and shares about them. Moreover, even the residents of California can’t opt out unless they fall under several exceptions. As stated in their California Privacy Notice:

The data included in our products and services are not subject to the CCPA as a result of certain exemptions found in the CCPA. Therefore, consumers (other than HR Data Subjects and B2B Data Subjects) will not be able to exercise rights granted under the CCPA.

The only people who can request to have their information removed are those who fall under the following two categories:

- HR Data Subject: a current or former job applicant, employee, or contractor of CoreLogic (Cotality).

- B2B Data Subject: a current or former employee, owner-director, officer, or independent contractor of a company, partnership sole proprietorship, non-profit, or government agency in connection with business-to-business (“B2B”) communications with CoreLogic (Cotality), including if you have visited their website.

If you fall under the HR Data Subject category, you may use the HR Data Subject Request Form for your opt-out.

Choose “Restrict Processing of My Data” as the request type, select your relationship with Cotality, enter personal information, and click the “Submit” button.

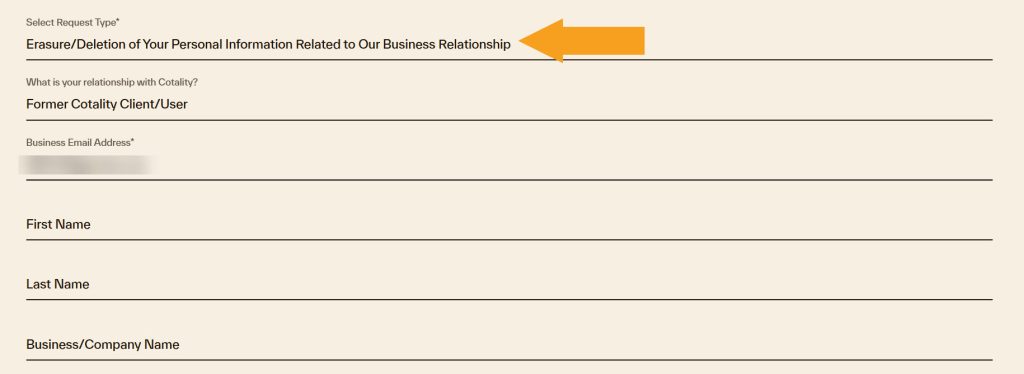

If you identify as a B2B Data Subject, use the B2B Data Subject Request Form.

Select “Erasure/ Deletion of Your Personal Information Related to Our Business Relationship” in the request type field, select your relationship with Cotality, type the required personal information, and submit the form.

Please note that Cotality might require you to provide non-sensitive identifiable information for verification. Such information includes your phone number, email address, full name, or mailing address. The company might ask for additional information via email or other means and won’t complete your request until you provide sufficient data that verifies you either as the Data Subject or an authorized agent.

Alternatively, you can also call 1-800-634-4149 to request CoreLogic (Cotality) opt-out. Be ready to provide identifying information and respond to follow-up questions.

Credco

As part of their solutions, Cotality.com provides merged credit reports that combine data from three national credit bureaus: Experian, Equifax, and TransUnion. Mainly, these reports are provided to mortgage lenders.

In order to contact Credco with inquiries regarding your credit reports, call customer service representatives at (800) 637-2422 Monday–Friday from 6:00 a.m. to 5:00 p.m. PST. Alternatively, send mail to Credco Consumer Services Department, P.O. Box 509124 San Diego, CA 92150.

Teletrack opt out

Teletrack is a consumer reporting agency that was previously owned by CoreLogic (now Cotality). Currently, Teletrack is an Equifax company, as a result of the acquisition in 2021. To remove your name from Teletrack lists and opt out of unsolicited credit and insurance offers, use the Equifax form and mail it to Teletrack, PO Box 740008, Atlanta, GA 30374.

How to contact CoreLogic (Cotality)

If you have questions regarding privacy practices, call 1-800-634-4149 or send an email to [email protected]. If you need support for a Cotality product, you can find the contact details on the customer support page. You can also find contact details of specific offices on the locations page.

Your data is still exposed on other brokers

Major data brokers like CoreLogic are a source of data for people-search websites like PeopleFinders, FastPeopleSearch, and BeenVerified. These sites make your personal information easily available online to anyone interested.

We recommend that you opt out of these five first:

- How to remove yourself from MyLife.com

- How to remove yourself from PeopleFinders.com

- How to remove yourself from FastPeopleSearch.com

- How to remove yourself from BeenVerified.com

- How to remove yourself from TruePeopleSearch.com

Go through this list and send opt-out requests manually to each data broker, or subscribe to Onerep to remove records automatically from 230 sites with just a few clicks.

CoreLogic (Cotality) quick links

About CoreLogic (Cotality)

- Founded: 2010

- Headquarters: 40 Pacifica, Irvine, CA

- Number of employees: over 1K

- Website URL: cotality.com

FAQs

What is CoreLogic?

Rebranded as Cotality in 2025, CoreLogic is a real estate data and technology provider. It shares property evaluations, legal filings, liens and judgments, ownership records, rental applications, tax payment status, mortgage obligations, and other relevant data with government agencies, lenders, insurers, and other professionals in the housing market.

Where do I send the CoreLogic opt out form?

To opt out of CoreLogic (Cotality), fill out the HR Data Subject form if you’re a current or former job applicant, employee, or contractor; fill out the B2B Data Subject form if you have current or former business relationship (employee, owner-director, officer, or independent contractor of a company, partnership sole proprietorship, non-profit, or government agency).

What does CoreLogic check for?

CoreLogic (now Cotality) gathers and shares such property-related data as home ownership, loan obligation records, tax payment status, liens and bankruptcies, consumer reports, and more. One of its solutions, called Credco, is a third-party consumer credit reporting agency that provides merged credit reports to mortgage lenders.

Can I stop CoreLogic from collecting my data?

Generally, CoreLogic (Cotality) doesn’t disclose to individuals what data it collects and stores about them. Additionally, the website doesn’t provide opt-out procedures unless you’re a California resident and fall under specific categories. You may contact [email protected] in regard to their Privacy Policy and the collection of your data.

Dimitri is a tech entrepreneur and founder of Onerep, the first fully automated data removal service. Top cybersecurity CEO of 2021 by The Software Report.