Is myFICO legit? What to know about the credit check app in 2025

The myFICO app is indeed legitimate—in fact, it’s brought to you by the very company that created the original FICO credit score. myFICO is the customer-facing service of FICO, a data analytics company that dates back to the 1950s. Since more than 90% of top U.S. lenders rely on FICO scores to make credit decisions, myFICO gives you direct access to the same scoring models banks, mortgage providers, and credit card issuers actually use.

What is myFICO?

myFICO was launched in March 2001 to give regular people a way to look up their credit score. This makes it easier to understand how lenders might view their financial health and gauge their ability to pay back loans.

The parent company of myFICO is FICO, which is short for Fair, Isaac and Company. FICO was founded in Bozeman, Montana in 1956 and went public in 1987. Its proprietary credit scoring model—the FICO score—is used by 90% of lenders. It weighs the following factors:

- your payment history

- how long your credit history is

- the types of credit you use (your “credit mix”)

- your new credit inquiries/applications (“hard inquiries”)

- how much you owe

People often confuse credit scores with credit bureaus. A credit score is simply the scoring system, whereas a credit bureau is a company that gathers the necessary information and produces a report (a “credit report”) that can then be used to calculate the score.

The three main credit bureaus in the U.S. are Equifax, Experian, and TransUnion. Creditors send data to these companies, but they might not send information to all three, which is why your reports can vary.

myFICO acts as the bridge between you and these bureaus—it pulls your credit reports directly from them and then calculates your official FICO scores based on that data.

How does myFICO work?

myFICO works by pulling your credit reports directly from the three major U.S. credit bureaus and then generating your official FICO scores from that data. Because lenders may check different bureaus, and because each bureau may have slightly different information about you, myFICO gives you access to multiple versions of your score so you can see what a bank, mortgage lender, or credit card company is likely to review. With subscription plans, you can choose whether to track one bureau or all three, and how often your scores update.

The application also provides the following additional services if you pay for certain subscription plans:

- identity theft monitoring

- credit report alerts

- credit score simulator (a tool that lets you see how certain credit-related actions will affect your score)

This sets it apart from free credit score apps like Credit Karma and Experian, which not only don’t provide identity theft monitoring services, but also aren’t going to give you a full picture of your credit situation. Some of these use the VantageScore model, which isn’t as widely used by lenders, and others only access credit information from one of the three major bureaus.

What myFICO can’t do

myFICO is pretty comprehensive as far as credit score reporting goes. That said, it doesn’t do everything. For example:

- It doesn’t improve your credit score. However, it can give you information that can show you where to make improvements.

- It doesn’t guarantee approval for loans or credit. A good credit score is never a guarantee, although it makes approval far more likely. Lenders might look at factors beyond just your score, such as your employment history.

- Its budgeting and financial planning features aren’t as robust as some other solutions. For these sorts of things, you’ll be better served by apps like Mint or NerdWallet.

Understanding the limits of the service is important for determining whether its monthly subscription cost makes sense for you and what to expect overall.

Is myFICO safe to use?

Yes, myFICO is safe to use. It’s backed by FICO, which is a trusted name in credit scoring that boasts decades of credibility. FICO undergoes regular independent third-party audits that assess its compliance with security standards and monitors changes in privacy regulations to ensure that consumer data is safeguarded accordingly.

When you input your SSN and other PII, myFICO encrypts this data and uses it to pull your reports directly from the credit bureaus. This ensures results that are both accurate and secure.

myFICO also offers two-factor authentication (2FA) and strongly encourages users to turn it on. 2FA puts an additional layer of security over your account so that even someone who’s figured out your username and password is stopped at login.

Why does myFICO need my SSN?

Your Social Security Number is the only identifier that’s uniquely assigned to you as a consumer in the United States. For this reason, any application offering credit tracking will need your SSN to make sure they’re giving you data from the right credit file.

You’ll also be asked for other personal data, including your date of birth and your address.

For myFICO’s identity theft monitoring services, your SSN is also a necessary starting point. If you don’t provide it, the service won’t be able to monitor whether it’s been associated with activities that don’t make sense for you (like new credit accounts or unusual credit inquiries).

Is MyFICO worth it?

Whether myFICO is worth it depends on your particular needs.

There’s no denying that credit scores play a major role in Americans’ lives. If you’re applying for a mortgage, car loan, or new credit, and you want to know the exact scores lenders will see, myFICO is probably your best bet. It will actually give you a variety of scores, including those that are tailored to specific types of loans.

The service is subscription-based, but you can get a one-off report for $19.95 with info from just one credit bureau and a three-bureau report for $59.85.

For casual monitoring over time, many people find it hard to justify shelling out around $30 every month (or nearly $40 if you’re looking for monthly updates) unless they’re also interested in identity protection. That said, the protection is limited to monitoring and insurance without device-level tools like VPNs or antivirus—which some people find limited.

What do users say?

myFICO has a strong rating of 4.8 stars on Apple’s App Store and is rated #162 in the Finance category. That said, of the people who actually wrote a myFICO review, there were many both positive and negative ones with many stating the app was not worth the money. Positive reviews said that the app was “great if looking for a house” and “very useful” when preparing to purchase an electric vehicle.

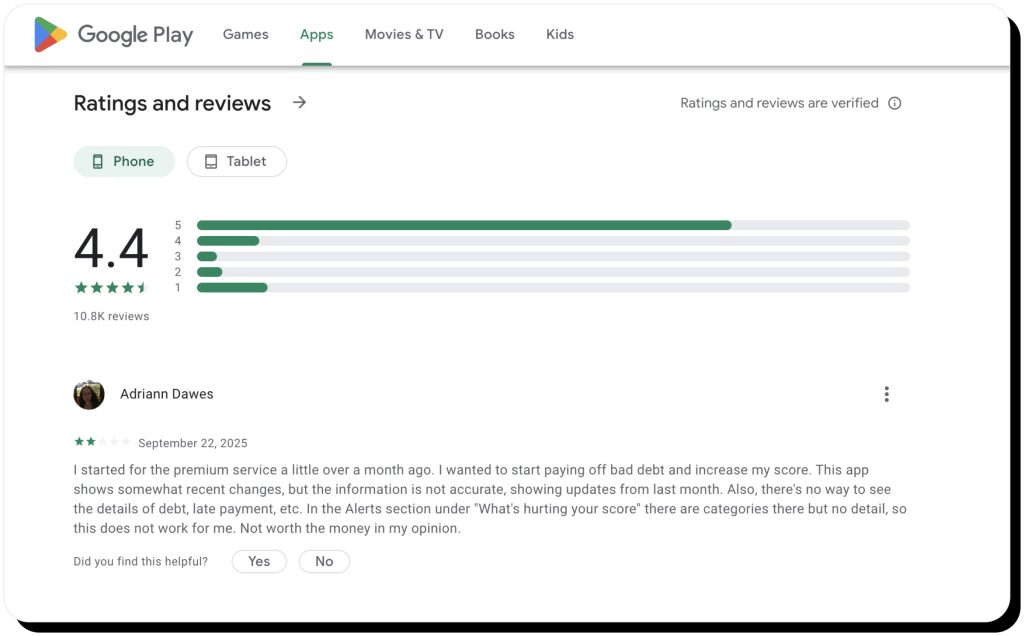

The rating on Google Play is 4.4 stars, with reviews being a mixed bag as well. Many people complain about a lack of details and slow updates, while others praise easy access to their scores.

This indicates that the best way to get value from myFICO is to use it in preparation for specific life decisions that will have a major impact on your finances. If you’re interested in continuous monitoring, you might be better off with other apps.

Alternatives to myFICO

If you’re not looking to use myFICO’s identity theft services, then it makes sense to check out the alternatives that offer credit score tracking. Here are a couple of options:

- Free services like Credit Karma and Credit Sesame. Like myFICO’s free option, these give you a certain amount of information without requiring you to purchase a subscription. Keep in mind, however, that these both use VantageScore, which isn’t as widely used by lenders as the FICO score.

- Experian CreditWorks. This one includes your FICO score, but it doesn’t collect your information from all three bureaus.

- Bank and credit card apps. Many of these now provide free FICO scores, but they’re generally limited to a single bureau. Examples include Bank of America and American Express.

Who should use myFICO in 2025?

If you’re getting ready to make a large-scale purchase that you need to get a loan for, then knowing your exact credit score—the one that lenders are actually going to be looking at—can be an advantage. myFICO’s loan-specific scoring system lets you really zero in on the specific type of loan you’re hoping to get, giving you a sense of what interest rates you’ll be likely to face before you start shopping around.

If you’re curious about how a number of different credit-related decisions will impact your credit in the near future, the Score Simulator feature can help you figure out which decisions will be the most beneficial. You can see how taking out a loan or paying down a credit card might affect your score, for example.

The service might not be the most applicable to situations where someone just wants a free overview and doesn’t need detailed monitoring. $30-40 a month can easily add up, so it only makes sense when someone wants to use myFICO’s services to the fullest extent.

FAQs

Is FICO your real credit score?

Yes, FICO is the credit score that the vast majority of lenders will be using. Keep in mind, however, that there are three different bureaus from which a FICO score can be calculated, so there can be some variation even among FICO scores depending on which bureau a credit report is coming from. The most comprehensive FICO scores are based on info from all three bureaus (Equifax, Experian, and TransUnion).

Can I trust myFICO with my personal information?

Yes, myFICO is safe to trust with your personal information, including your Social Security Number. The application provides robust encryption for all personal data and follows industry standards that outline how that data must be safeguarded.

How much does myFICO cost?

A free myFICO plan provides 1-bureau coverage with monthly updates. For $29.95/month, you get 3-bureau coverage with updates every 3 months. For $39.95/month, you also get 3-bureau coverage but monthly updates. Both paid plans also include identity monitoring services and identity theft insurance. You can also get one-time reports: $19.95 for a report from only one bureau and $59.85 for all three (Experian, Equifax, TransUnion).

Does myFICO hurt my credit score?

No, checking your credit score through myFICO won’t impact your score. Only a “hard inquiry” (when you’re applying for a new line of credit and a lender is checking your score) may put a slight dent in your score (usually by about 5 points). The reason is that opening up new lines of credit can signal that you’re in financial distress. However, simply checking your score for your own elucidation counts as a “soft inquiry” and won’t change your score at all.

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.