Identity theft: definition, warning signs, risk factors and how to avoid it

Identity theft is a type of fraud when one’s personal information gets stolen and used to obtain benefits, receive medical care, access the victim’s money, and commit other crimes. It can take various forms, including financial, criminal, medical, and child identity theft. ID fraud often has significant and long-lasting effects on victims, making it crucial to take proactive steps to protect one’s personal information and safeguard their identity.

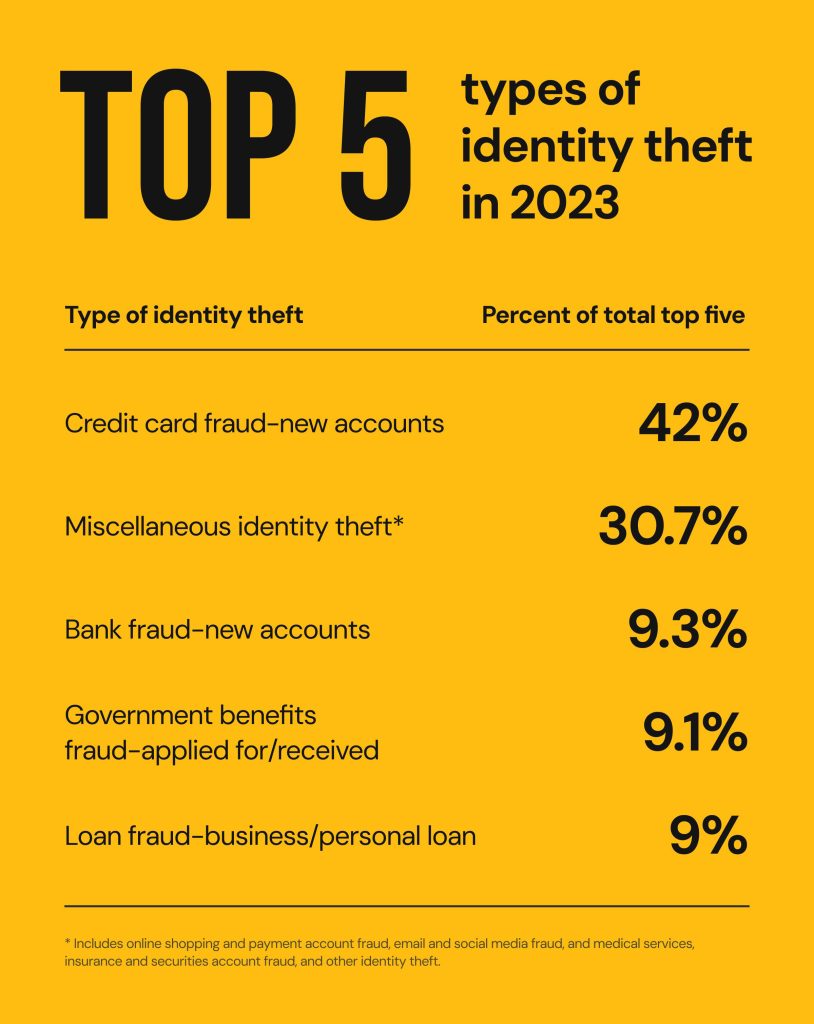

The Federal Trade Commission (FTC) took in over 1.1 million identity theft reports in 2022. It turns out, the COVID-19 pandemic and switching to online banking and payments have been a breeding ground for identity theft. Not only has identity theft increased but it has evolved – the most common form of ID theft in 2020 concerned imposter scams, which have grown by 1.72 million reports since 2019.

The identity theft landscape is changing quickly, and that means it has never been more important to stay informed about protection and prevention in the modern age. According to data compiled by the Federal Trade Commission and Consumer Sentinel Network, about one in fifteen people will be identity theft victims. Are you prepared?

What is identity theft?

Identity theft occurs when someone commits fraudulent activities using your identity. This can have highly disruptive consequences, such as financial loss, ruined credit scores, criminal records, and much more.

This is accomplished by stealing personally identifiable information (PII) that lets an identity thief pretend to be you. That includes information such as Social Security numbers, bank account numbers, car and medical insurance numbers, and even security question details such as your hometown, first school, mother’s maiden name, and more.

What can identity thieves do with your personal information?

There’s a reason identity-related records, such as your Social Security number, are so sensitive. If someone gets ahold of them, they can cause a lot of damage before anyone catches on. Here are just a few crimes that identity thieves can commit if they’ve compromised your personal information:

- Open new lines of credit: One of the biggest risks of identity theft is finding out someone has destroyed your credit score by maxing out new credit cards and leaving you with the bill. This is a seriously disruptive crime that can take a long time to recover from.

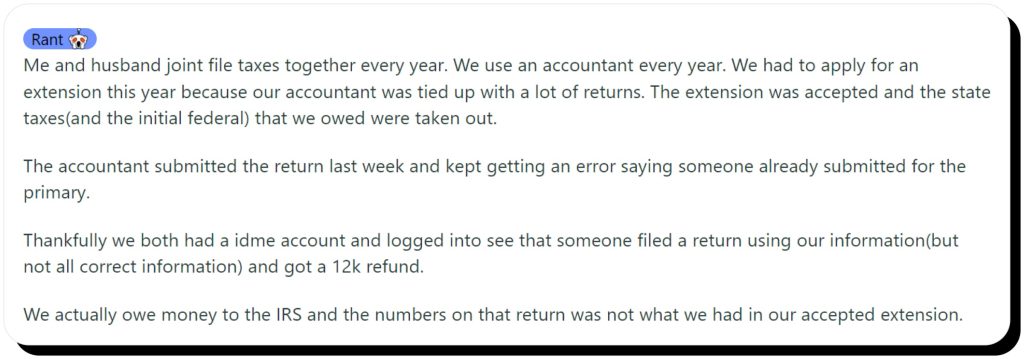

- File fraudulent tax returns: Of course, making money is one of the biggest motivators for identity theft. If an identity thief has your Social Security number, they can use it to claim your tax return and then vanish before you know what happened.

- Commit health insurance fraud: Medical care can be very expensive, and if a criminal has your personal information, they can pretend to be you, get their procedures done, then leave you with medical bills.

- Pass a background check: Some identity thieves don’t want anyone else to know that they’re criminals. So, they can steal identities to pass background checks, letting them use your good record for their own employment or housing opportunities.

- Drain existing accounts: Even if they don’t have your bank passwords, cybercriminals can use your Social Security number and other personal information to access your bank account, lock you out of it, and then drain it.

How does identity theft happen?

Now that so much of our lives is stored on the internet, it’s surprisingly easy for identity thieves to get a hold of identities. But how do thieves steal an identity? Here are a few of the most common ways:

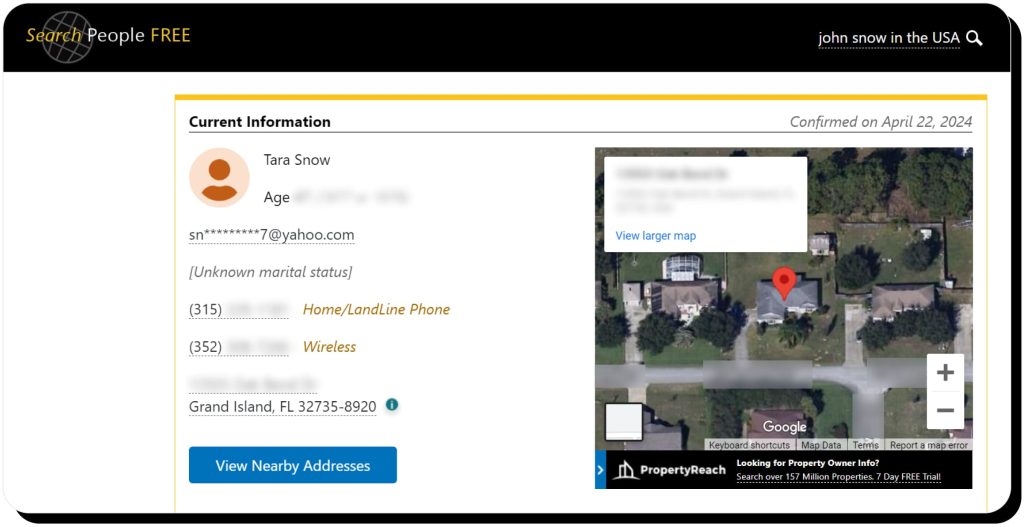

- Tracking down you online: The Internet is a treasure trove of personal information. Not only do people overshare on social media, but the companies and services we use also spread our details around. The truth is, personal information is a big business, which explains the prominence of people-search sites like Spokeo, PeekYou, PeopleFinders, MyLife, FastPeopleSearch, and others. Unfortunately, criminals can also access the personal information published there, which makes it much easier to find targets and steal identities.

- Data breaches: For cybercriminals, sometimes stealing an identity is as simple as sitting back and waiting for the information to come to them. If a bank, credit card company, or service that you’re associated with has a security breach and its data gets compromised, your personal information could be exposed. This is a breadcrumb trail that can lead thieves right to your important accounts and identity.

- Malware: One of the most effective ways for identity thieves to steal your identity is to gain access to your online accounts. Malware and viruses make this a breeze as these tools can quickly collect your passwords and banking information and send them to the criminal. From there, they can lock you out of accounts, stealthily open up new lines of credit, or claim a fraudulent refund.

- Mail crimes: Whether it’s dumpster diving for sensitive mail, diverting your mailing address to their own place, or stealing envelopes directly from your mailbox, identity thieves can easily locate sensitive information if you aren’t shredding documents or collecting mail every day. If they don’t get your Social Security number outright, they can use this wealth of information to find it. Even utility bills and pre-approved credit offers could expose enough personal details for identity fraud.

- Theft of personal items: Your wallet, mobile phone, laptop, and other devices are primary gateways to your personal data. As we keep more and more records and personal documents in electronic form, brief access to your phone accounts can give criminals everything they need to steal your identity. And even if your accounts are well-protected and hard to hack, such a common crime as credit card theft can lead to unauthorized purchases in the best case and a damaged credit score in the more likely case.

Who’s at risk of identity theft?

Technically, everyone is vulnerable to identity theft, but some life events and age groups make you especially at-risk. Let’s take a look at the populations who should take extra caution with the security of their identities:

- Children: Unlike adults, children don’t have credit histories, and parents don’t have a reason to request credit reports on their kids. This makes it easy for identity thieves to open accounts in a child’s name and remain unnoticed – especially if parents post a lot of personal information about their child on social media.

- Gen Z and Millennials: Younger generations are also at a heightened risk of identity theft. These individuals were born and raised in a digital world, and while this means they tend to be pretty savvy when it comes to online security, it also means their digital footprints are huge. This is all grist for the identity theft mill. Even if social media accounts use conservative privacy settings, an accepted friend request is all a cybercriminal needs to begin.

- Newlyweds: The last thing on the minds of newlyweds is their online security – but if you recently got married, you could be at a heightened risk of identity theft. As you begin restructuring your finances, such as opening up joint bank and brokerage accounts, highly personal information could be exposed. Combine this with all of the new information posted online about your wedding and future plans, and newlyweds could be prime targets of ID theft.

- Recently separated: For the same reason newlyweds can become targets of ID theft, divorcees can also be vulnerable. New accounts will be opened, joint accounts will be closed, and this activity could expose personal information. Many couples have one tech-savvy person who handles all of the technology and finances, so operating without this person may also lead to compromised sensitive information.

- New parents: Having a baby is an exciting life transition, but it also introduces new security threats that parents must be aware of. For instance, having a baby leads to a lot of new records being generated. This puts more information on your child and yourselves out in the open, leaving you susceptible to identity theft. Mix that with the exhaustion that all new parents know so well, and it can be easier than ever to make cybersecurity mistakes.

- New homeowners: Moving into your first home also generates a lot of new records and requires handing out more personal information. This is just another way that your digital footprint increases, leaving you more vulnerable to being targeted. Your home and its associated transaction details will also become easy to locate online, which could help cybercriminals access more sensitive data.

- Senior citizens: Senior citizens have always been popular targets of cybercriminals. Many are less able to spot scams, making it easier for criminals to get their personal information (like their Social Security numbers) right from the source. They’re also less likely to request and scan their credit report and bank statements for fraudulent activity, making it easier for ID theft to go unnoticed.

What are the types and warning signs of identity theft?

There are various forms of identity theft, so it’s important to know how your compromised personal information could be abused. Here are some common types and red flags you need to watch out for:

- Criminal identity theft: If someone commits a crime and gives the police a false identity, they’re committing criminal identity fraud. This is an especially disruptive crime that lets the criminals keep their records clean, leaving you to pick up the pieces.

Red flags: Despite living a crime-free life, you may find yourself detained by a police officer for someone else’s crimes, lose employment opportunities or promotions based on failed background checks, or face fines for crimes that you never committed. - Tax identity theft: If a cybercriminal uses your personal information to file a tax return in your name, they’re committing tax identity theft. Many people don’t know that their tax refund was stolen until it’s too late. To spot this type of ID theft, we recommend keeping tabs on your tax activity and regularly scanning your credit report for suspicious activity.

Red flags: If the IRS isn’t letting you e-file your return, this could indicate that someone else filed a return using your Social Security number. Another warning sign of tax-related identity theft is finding unfamiliar employers on IRS records. - Synthetic identity theft: When fraudsters create an identity by combining made-up information with real information, they’re committing synthetic identity theft. This lets criminals steal government assistance funds or benefits, gain residency in the U.S., or “piggyback” off of someone else’s credit score.

Red flags: Due to the nature of synthetic identity theft, it can be very challenging to spot. It’s more likely that you’ll stumble upon it accidentally, such as if you freeze your child’s credit and discover that someone is using their SSN.

- Medical identity theft: The rise of telemedicine has made it even easier for cybercriminals to steal your sensitive records and get away with medical identity theft. This crime occurs when someone gets medical assistance using your identity, leaving you with the bill.

Red flags: If you’re being charged for medical services that you never received, someone may be using your identity to get medical care. Watch the mail for notices from your insurance, bills, and carefully scan medical records and reports for more fraudulent activity. - Financial identity theft: This type of fraud occurs when someone uses your credit or debit card information to make unauthorized purchases, takes out loans and lines of credit or opens new financial accounts in your name, hacks your accounts to withdraw funds or make unauthorized transfers, or commits other financial manipulations.

Red flags: Common signs of financial identity theft are unfamiliar withdrawals or charges on your bank or credit card statement, bills, collection notices, or statements for accounts you didn’t open, debt collector calls regarding accounts you don’t recognize, errors on your credit file, and unexpected denials of credit applications. - Child identity theft: This is a particularly disruptive type of ID theft. Stealing the identity of a child can derail their lives, and it often goes unnoticed until the child grows up and realizes that their credit score is destroyed.

Red flags: If you’re receiving bank statements, credit card offers, or debt collection activities under your child’s name, someone may have stolen their identity to commit financial crimes. - Senior identity theft: Targeting the identity of senior citizens is very common because this population tends to live off of savings and, as a result, isn’t as vigilant about account statements. The criminal can often keep up their charades after the victim passes away, leading to even more problems for the estate.

Red flags: Financial services and healthcare are the two most common utilities for seniors and their families and both require submission and processing of personal information. Identity theft associated with these services is not rare and can result in fraudulent charges on senior person’s account statements, bills for medical treatment they never had, or phone calls and emails from debt-collecting agencies seeking to collect debts in their name.

Steps to take if your identity is stolen

If you’ve fallen victim to identity theft, acting quickly is imperative. Recovery may vary based on the type of theft committed, but there are several general steps applicable in all cases:

- File a report with the Federal Trade Commission at IdentityTheft.gov. The website also outlines a recovery plan you should follow.

- Contact one of the major credit reporting agencies (Equifax, Experian, or TransUnion) and place a fraud alert on your credit report. Consider placing a credit freeze as well – this will restrict access to your credit report, making it harder for fraudsters to open new accounts in your name. You might also use Experian’s credit monitoring service which will alert you about changes and suspicious activity on your report.

- Report to the fraud departments at your bank, credit card issuers, and other relevant entities and government agencies. It’s also a good idea to close your current credit cards and request new ones.

- File a police report with your local law enforcement.

- Close all the accounts opened by criminals and dispute fraudulent returns and charges.

- Change login credentials for all important accounts, both affected by the attack and not.

- Keep a close eye on your credit report and bank account statement for any new suspicious activity.

Identity theft prevention vs. identity theft protection

There are plenty of online services and insurance companies that promise to protect you from identity theft. They offer a variety of solutions that help you monitor your credit accounts and score, alert you if any suspicious transactions are detected in your financial accounts, monitor the dark web for your information, help to place a security freeze on your credit, and even reimburse your funds if identity theft occurs.

Onerep recommends trying services like Lifelock or IDShield for your protection. What ID theft protection companies can’t do, however, is prevent identity theft. That’s why we created Onerep — our automatic sensitive information removal tool helps you avoid identity theft by deleting your private information from people-search sites.

Removing yourself from these sites is essential if you want to prevent identity fraud, but it is also notoriously difficult. After all, people-search sites aren’t in any rush to delete your profile, which is why many provide confusing instructions on opting out. Onerep will take this burden off your shoulders and remove your sensitive information in three steps.

Scan

We scan 231 data broker websites to find your “profiles”— pages with your personal information that were created without your permission.

Delete

We send requests to each website on your behalf, asking for your profile to be removed. No matter how complex the opt-out process of a site is, we persist until the profile is removed — and update you along the way.

Monitor

Once a month we revisit 231 data broker sites to check if your information has popped back or appeared on other sites as it sometimes happens. If this is the case, the removal starts all over.

In just three steps, our powerful privacy tool minimizes your online presence, helping you regain control of your information. After all, maintaining privacy online is one of the few ways that you can thwart identity theft before it happens.

Bottom line

Identity theft may be scary, but with the tools and information provided both by the federal government and independent organizations, you can keep your sensitive data safe and stay out of trouble. Since people-search sites are significant distributors of this information, we highly recommend opting out of them. You can do this manually using our guides, or sign up for a free trial of our automatic privacy protection tool to discover how we do it for you.

Sources

- https://www.consumer.ftc.gov/features/feature-0014-identity-theft

- https://www.ftc.gov/reports/consumer-sentinel-network-data-book-2020

- https://www.iii.org/table-archive/20279

- https://www.idtheftcenter.org

- https://www.usa.gov/identity-theft

- https://www.irs.gov/identity-theft-central

- https://www.irs.gov/newsroom/taxpayer-guide-to-identity-theft

- https://www.justice.gov/criminal-fraud/identity-theft/identity-theft-and-identity-fraud

- https://www.consumer.gov/articles/1015-avoiding-identity-theft

- https://www.fbi.gov/scams-and-safety/common-scams-and-crimes/identity-theft

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.