Is Venmo safe for Facebook Marketplace? The hidden risks behind the convenient app

Venmo is a convenient way to pay someone you know and trust, but it’s risky for Facebook Marketplace transactions with strangers. Venmo lacks identity verification, offers very limited purchase protections, and typically doesn’t allow reversing payments—which makes it vulnerable to numerous scams.

Is it safe to accept Venmo for Facebook Marketplace?

Both Venmo and Facebook Marketplace began with the intent of supporting people who know and trust each other. The usual verification measures matter less when you’re sending money to a friend, which is why Venmo makes peer-to-peer payments so easy. It is also the reason why there aren’t robust purchase protections in place and transactions are basically irreversible.

Scammers take advantage of Venmo’s simplicity as well:

- It’s super easy to create an account (there’s no identity verification)

- It’s fairly simple to impersonate familiar contacts or even businesses

- It’s difficult (and often impossible) to reverse a transaction

Facebook Marketplace, in turn, has its own share of risks. Both buyers and sellers lament about how much scamming is occurring on Facebook Marketplace as of late, even calling it “an industrial-size garbage dump” and “pure scam heaven.”

Articles in reputable news organizations back up these accounts, and it’s clear that people aren’t just being hyperbolic. In fact, one staff writer at Wired relayed her experience of trying to sell a futon and getting nothing BUT scammers for months.

All this aside, Facebook Marketplace remains incredibly popular and has even been credited for getting younger users back on the site. Despite the scam risk, it’s here to stay.

So, for anyone wondering “Should I accept Venmo on Facebook Marketplace?” the answer is that you can, but proceed with caution. You can certainly use it in situations where you’re confident about the identity of the person you’re communicating with. However, there are much safer options you should consider when dealing with strangers (we’ll get into these in a bit).

Risks of using Venmo for Marketplace transactions

Based on the premise that you know and trust the person you’re sending money to (or accepting money from), Venmo didn’t work very robust purchase protection measures into its design.

For the most part, payments are irreversible, and there’s no way to cancel the money you just sent. It’s really up to you to get the other party to send it back, and a scammer isn’t likely to cooperate.

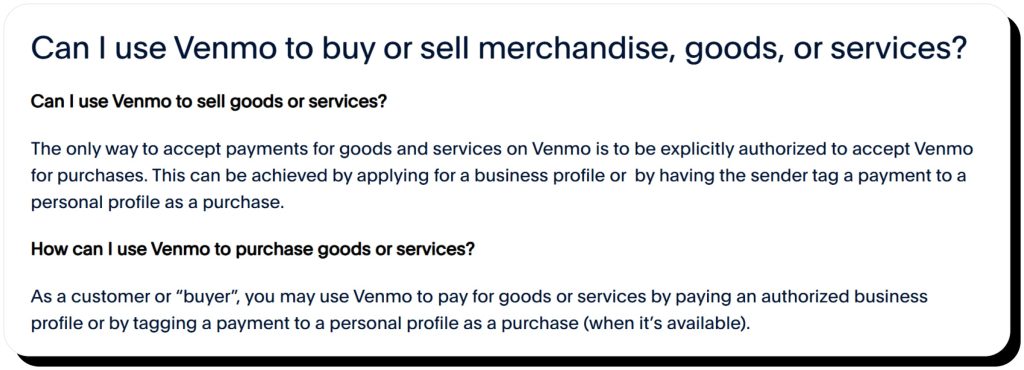

Venmo does have some purchase protection, but it’s limited to authorized merchants and business profiles. It doesn’t cover transfers to personal accounts that aren’t identified as goods and services. Additionally, engaging in “unauthorized commercial activity” without a Venmo business profile might result in your account getting frozen due to a violation of terms of service.

What happens if you get scammed?

If you get scammed, and your transaction isn’t covered by purchase protection, then there’s not much Venmo can do. However, it’s always worth contacting Support—if anything, you’ll raise awareness about the latest scams going around.

After contacting Venmo Support, it’s also recommended that you:

- File a dispute with your bank or card issuer

- Report the fraudulent profile on Facebook Marketplace

- Monitor your financial accounts for suspicious or unauthorized activity

If the scam has drained your bank account by a huge amount, file a police report. You should also contact law enforcement if you believe your identity has been stolen. Be sure to keep a record of any messages between you and the scammer and screenshot any transactions. This can help with investigations, particularly if you decide to report the scam to the Federal Trade Commission (FTC).

Common Facebook Marketplace Venmo scams

Con artists have learned to exploit the layer of trust that’s created when you see a person’s Facebook profile replete with photos, posts, and a list of friends. Unfortunately, these things can be spoofed, often with hacked or abandoned accounts.

Armed with a veneer of real person-ness, a scammer may attempt any of the following Venmo scams on Facebook Marketplace:

- Fake payment confirmation scam (targets sellers). The scammer will try to convince you to send over the item by showing you false proof of payment, either by means of a fake transaction screenshot or an email confirmation that looks like it’s coming from Venmo. This supposed “proof” may be convincing enough to make you ignore the fact that your Venmo app isn’t showing any incoming payment.

- Overpayment scam (targets sellers). The scammer will typically use a stolen credit card to pay you an amount exceeding your stated selling price and will then ask you to refund the excess. Once you refund the money, you’ll find that the original transaction has been reversed as well. (This is because Venmo does reverse transactions that have been made using stolen cards.)

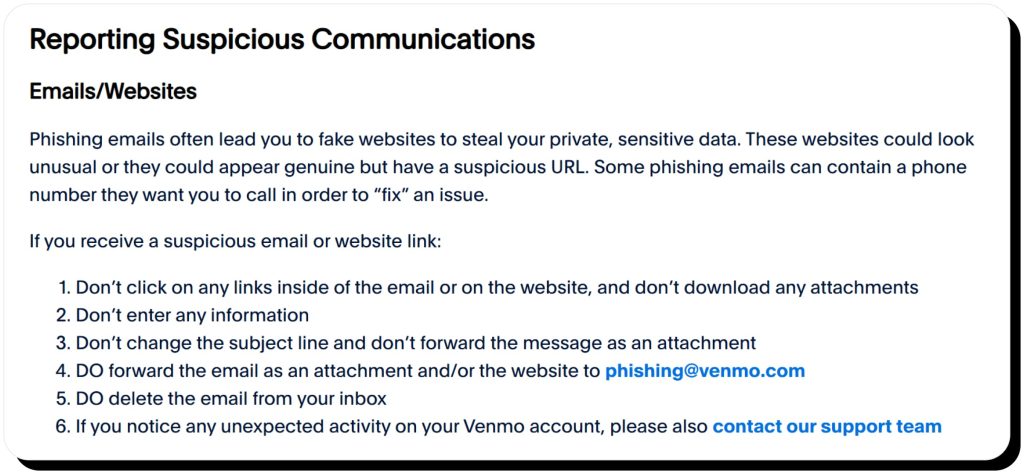

- Phishing (targets both buyers and sellers). You might receive a call or a text message from someone pretending to be Venmo, possibly around the same time that a fake buyer or seller informs you of a supposed transaction “error.” The Venmo impersonator will try to get you to reveal your login information, such as your email address, your password, and possibly the code sent to your phone if you’re using two-factor authentication (2FA).

- Urgent payment requests (targets buyers). If you’re getting pressured to pay before you see the item and do it swiftly, that’s a red flag. There may very well be no such item. Asking for additional photos from different angles can help you confirm the item’s existence, but even then, some scammers can find ways to keep the fakery coming.

- Receiving worthless merchandise (targets buyers). If you haven’t been able to see the actual item, there’s always a risk that you’ll pay good money just to receive broken or fake goods after the payment. If you haven’t been using Purchase Protection, you’re unlikely to get your money back.

- Business profile impersonation (targets buyers). Scammers can fairly easily pretend to be a legitimate business on Venmo by putting up the business’ logo, details, and photos and selecting a username that rings true. In addition to defrauding buyers, this can also harm the reputation of the businesses being impersonated.

These are just a few of the Venmo scams that can be encountered on Facebook Marketplace and other platforms. Check out our guide on recognizing and avoiding Venmo scams to dig deeper into this subject and learn how to tell the difference between Venmo impersonators and the real company.

How to use Venmo safely (if you must)

Although it’s a bit of a red flag if a Marketplace buyer or seller insists on using Venmo, it’s possible to enjoy the app’s convenience without excessive risk—if you take certain precautions. Here are a few tips for using Venmo safely on Facebook Marketplace:

- Only accept payments from people you know. If that’s not someone you know personally, check if you have mutual connections. If there are some, it’s a good idea to ask them if the person is trustworthy and reliable.

- Avoid default peer-to-peer payments when dealing with strangers. There’s no way to dispute an ordinary (non-commercial) payment, so it’s best not to use this one with people you don’t know.

- Check the payment status in your Venmo account before you give away the item. No matter how convincing the scammer’s transaction screenshot is, don’t consider things settled until the money is actually in your account—and not simply “pending” (or, for that matter, canceled immediately upon arrival).

- Be wary of overpayments. If a stranger overpays you and asks for a refund, don’t send anything right away. Similarly, if you get a payment out of the blue from a stranger who professes to have paid you by accident, there’s a solid reason to be suspicious. It’s best to contact Venmo and wait to see if the payment turns out to be legit or fraudulent.

- Avoid using Venmo for large transactions. Platforms like PayPal and Facebook Checkout provide much better protection when paying larger amounts. Venmo’s speed and convenience aren’t worth risking several hundred, let alone thousands, of dollars.

- Meet in person and verify everything. There are lots of things that you can’t be sure about unless you actually meet with the buyer or seller. Additionally, scammers often avoid face-to-face meetings, so insisting on one is an easy way to weed them out.

- Keep your conversation on Facebook Messenger. A big red flag is when someone insists on moving to another messaging platform. Even if they have what seems like a good excuse, the real reason is probably that they’re trying to escape Facebook’s fraud detection.

Best alternatives to Venmo for Facebook Marketplace

Paying digitally in what is essentially an online flea market is always a bit of a gamble. To increase your odds of success, it’s better to choose options that come with little risk but robust protections:

- Cash. Unless it’s counterfeit, this is a payment you can count on. You’ll want to make sure to meet the buyer or seller in a public place for safety, and perhaps even bring a friend.

- Facebook Checkout. Facebook Checkout has more robust customer support than Venmo, although it’s mostly done through bots and AI. Many Marketplace users recommend using Facebook Checkout with a credit card or prepaid Visa rather than a debit card.

- PayPal Goods and Services. First, PayPal has a more robust identity verification process. Second, it offers built-in buyer and seller protections, including dispute resolution if something goes wrong.

How Onerep helps prevent payment fraud

In our digitized world, not only can scammers hide behind a veil of anonymity, often impersonating trusted companies, but they can also find all the personal details they need to craft convincing phishing and social engineering attacks.

One way to minimize the likelihood of getting scammed is to make sure that your private information isn’t easily available online. A crucial step for that is to remove yourself from data brokers, which make your personal details easily Googleable. The broker sites expose your home address, contact info, income, interests, assets, legal records, and much more—to anyone interested.

Onerep helps you regain your privacy by removing your personal information from 232 data broker sites. The service scans the brokers to find all the pages that expose your data, then sends opt-out requests on your behalf. Once removal is complete, Onerep runs regular rescans to make sure your information isn’t republished.

By opting you out of data brokers, Onerep ensures that your exposure to scams, identity theft, and financial fraud is significantly reduced.

FAQs

Is it safe to accept Venmo for Facebook Marketplace from a stranger?

You can accept Venmo from strangers on Facebook Marketplace, but be sure to verify that the transaction has gone through before giving away any items. If the person overpays, wait a while to make sure that the payment hasn’t come from a stolen card, and contact Venmo to verify the transaction is legit.

Can Venmo payments be reversed by a scammer?

Venmo can reverse payments that have been made using a stolen card. Unfortunately, if you pay a scammer using your own Venmo account, that’s typically not possible to reverse.

Does Venmo offer buyer or seller protection for Marketplace deals?

Venmo does offer buyer protection when you deal with an authorized business profile. Unfortunately, these protections aren’t available for an average peer-to-peer transaction.

What’s the safest way to accept payments on Facebook Marketplace?

The safest way to make sure you get your money is to insist on cash. Of course, that opens up a slightly different security concern, given that you’re meeting a stranger in person. If you prefer digital payments, consider using Facebook Checkout.

Is PayPal safer than Venmo for Marketplace sales?

PayPal is much safer for Facebook Marketplace than Venmo due to better protection for buyers—as long as you select “Goods and Services.” This adds a small fee to the purchase, which the recipient may pass along to you.

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.