Dark web alert: what it means and what to do next

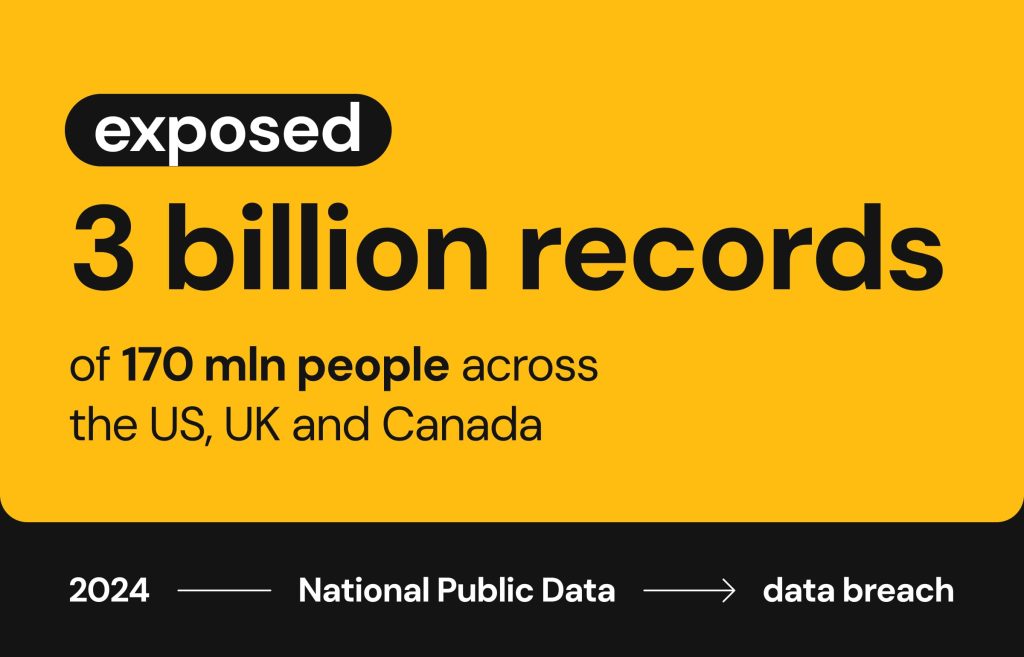

Data breaches have become so commonplace, we often forget how truly mind-boggling they are. It would take you a few minutes just to scroll through all the data breaches from March 2025 alone. In 2024, the single breach of National Public Data exposed nearly three billion records of 170 million people across the US, UK and Canada.

Where does this stolen data end up? Most of the time, it’s put up for sale on the dark web.

One of the ways to get notified about your personal data breach is to set up dark web monitoring alerts. A dark web alert means your information was found on a suspicious part of the web called the dark web, where it’s most likely being sold by cybercriminals.

Let’s look at how dark web alerts work and whether getting one means any immediate danger for you.

What is a dark web alert?

A dark web alert is a notification informing you that a piece of your personal data—such as name, email, credentials, address, Social Security number, phone number, etc.—has been found for sale on the dark web. You can get this alert either from a specialized dark web monitoring service or ID protection service you opt for, or from your bank if it supports this feature.

Your personal data might have been stolen in a phishing or social engineering attack. But most of the time, it happens through data breaches and cyberattacks that affect thousands of people worldwide.

Getting a dark web monitoring alert doesn’t mean you’re at risk right now but it’s the essential first step to mitigate potential consequences by securing your social, medical and financial accounts.

How dark web monitoring works

Since the dark web went mainstream some time in the late 2000s, it has become a gathering place for hackers, scammers and cybercriminals of all sorts. The dark web encrypts all traffic and anonymizes its users so they can communicate safely, and it can only be accessed using anonymizing browsers like Tor that can navigate the overlay networks the dark web is built on.

While the dark web can be used for many benign purposes like research and freedom-of-speech advocacy, its anonymity also covers up those engaging in dangerous and illegal activities. This includes selling and buying stolen personal data on the dark web’s many black markets.

Dark web monitoring tools automatically scan darknet marketplaces, data breach dumps and forums for traces of specific personal information of an individual or an organization. Once they detect a match between the monitored information and the data exposed on the dark web, they trigger an alert, signaling that a security action is needed.

While you can explicitly sign up for a dark web monitoring or ID protection service, some banks, credit card companies and employers offer dark web monitoring integrated into their systems. This helps protect personal information preemptively, with examples of such free services including Capital One and Chase.

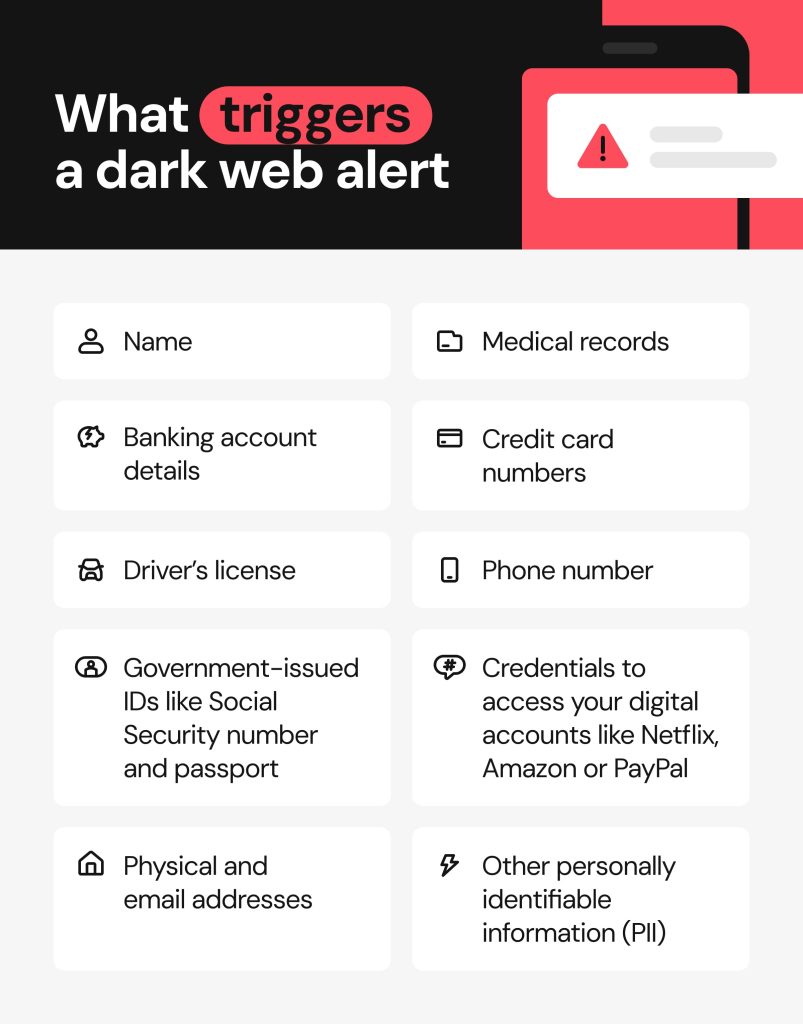

What triggers a dark web alert

A dark web alert is triggered when the monitoring tool detects your sensitive information being leaked, shared and sold on the dark web. The monitoring tools employ a variety of scanning techniques to do this, but the end result is this: personal data is identified as compromised and exposed on the dark web.

The types of detected personal information can include:

- Name

- Physical and email addresses

- Government-issued IDs like Social Security number and passport

- Driver’s license

- Banking account details

- Credit card numbers

- Medical records

- Phone number

- Credentials to access your digital accounts like Netflix, Amazon or PayPal

- Other personally identifiable information (PII)

Examples of dark web alerts you might receive

Dark web alerts come in many formats, depending on the monitoring service you use and the dark web activity detected. Examples can include the following:

- A dark web credit alert can say that your credit card information has been found on a dark web marketplace, showing your card number, CVV and its expiry date. In this case, your card can be used for fraudulent purchases.

- A phone number dark web alert may state your phone number and the last four digits of your SSN have been listed in a forum post. This is a common PII combination used in phishing and account recovery fraud.

- A full identity exposure dark web alert may say your identity details (full name, birthday, address and SSN) have been revealed on a dark web forum or marketplace, and can be exploited for taking out loans or applying for credit accounts in your name.

The benefits of dark web alerts

While dark web alerts themselves can’t protect your personal data, they act as early warning systems and prompt you to take timely action to protect yourself from further harm.

The key benefits of dark web alerts are:

- Instigating fast action: Once you know your data has been compromised, you can secure your accounts and prevent potential damage.

- Preventing further damage: As you change passwords, freeze your credit, alert your financial and medical service providers and set up multi-factor authentication (MFA), you curb cybercriminals’ attempts to reap any benefits from exploiting your data.

- Seeing the bigger picture: When you know what specific information has been leaked, it helps you to take targeted actions instead of panicking. Getting a dark web alert can also have a sobering effect, raising your awareness of cyberthreats and helping you improve your digital security hygiene to prevent further incidents.

Does a dark web alert mean you’re at risk of identity theft?

What does it mean when you get a dark web surveillance alert? Are you automatically at risk of identity theft or a related security risk? Well, yes and no.

Depending on how long your personal data has been floating on the dark web, it might have been purchased—or not yet. In either case, getting an alert means you still have time to protect yourself from identity theft if you take the necessary measures.

What a dark web alert really means

Dark web alerts can’t show you if your personal data has already been exploited by malicious actors. What they really show is that you’ve been a victim of some data breach, and your personal details are now available for cybercriminals to purchase to forge your identity, take loans in your name, impersonate you online, or break into your bank account, among other frustrating consequences.

How criminals use stolen data

Once stolen, personal data can be used in a variety of ways. Often it’s enough to have just someone’s name and email address to exploit this data maliciously.

Here’s how cybercriminals typically exploit the personal details they can get their hands on:

- Selling the personal data packages known as “fullz” — complete with names, addresses, SSNs, phone numbers and credentials — to fraudsters looking to buy ready-to-use identities.

- Credit card fraud where cybercriminals use the credit card data to clone physical cards, make fraudulent purchases and buy subscription services.

- Identity theft where your personal data is used to make fraudulent transactions in your name, such as opening new credit, taking out loans, claiming government and unemployment benefits, renting property, filing fake tax returns and so on, for some kind of financial gain.

- Account takeover: unless you have activated MFA, it’s enough to have just a login and password combination to break into your accounts. Cybercriminals can then make use of your banking or shopping accounts, lock you out of them, send phishing emails to your contacts and so on.

- SIM swapping: having enough personal data about someone, cybercriminals can social-engineer phone operators into transferring this person’s phone number to their SIM card. The scammers can then intercept texts and calls, including verification codes, and gain unauthorized access to this person’s accounts.

- Blackmail and extortion: in case cybercriminals gain access to sensitive data, they can use it against the person by blackmailing them and causing public embarrassment. Businesses may face ransomware attacks and be threatened with leaking their customers’ data.

Should you be worried about a dark web alert?

Even if a dark web alert comes up, it doesn’t mean your data has already been exploited. It does mean, though, that you need to take immediate action to secure it, and here’s why:

- Your data is in the wild. Unless you protect it and change all the affected credentials, it can be exploited at any time.

- You can become a victim of identity theft or account takeover unless you secure your details.

- Stolen data can be exploited even years after the breach occurred, so you should take action regardless of how much time has passed, even if you’ve been fine so far.

It helps to know that it’s nearly impossible to remove your data from the dark web, so it’s best to mitigate the risks by taking the steps below.

What to do if you get a dark web alert

Here’s how to protect yourself in simple and practical steps:

Change affected passwords immediately

If your passwords have been compromised, change them at once, including on all the accounts where you’ve reused these passwords.

Turn on two-factor authentication for key accounts

Another crucial step is to enable two- or multi-factor authentication, preferably through a phone app, not your phone number. In addition to your affected accounts, you can extend this security measure to all other key accounts, including email, banking, social platforms and subscription services.

Update security questions and backup contact information

In case your personal details (such as hometown or birthday) have been leaked, they can be exploited to answer security questions and reset access to your accounts. If this has happened, change the security questions to the ones only you know the answers to (or even invent fake ones), update your recovery emails and phone numbers, and review your listed trusted devices and delete suspicious logins, if any.

Review financial and online account activity

Check your bank and credit card statements for any unauthorized or unusual transactions. In addition, check your online accounts for password reset requests you didn’t make, logins from unknown locations or devices, and new services activated in your name.

Freeze your credit to prevent new account fraud

If your personal data has been compromised, it might be helpful to freeze your credit altogether. For this, contact the credit bureaus (if you’re in the US, the major ones are Equifax, TransUnion and Experian) and place a freeze. This won’t affect your credit score and is especially important if your SSN and full identity have been leaked.

Check if your information has been used in a known breach

You can use services like Have I Been Pwned to check if your email address was disclosed in any of the known data breaches. It helps you investigate how your personal details came up on the dark web and take precautions to prevent further exposure from happening again.

File an identity theft report if you see signs of fraud

In the severe case of an active fraud against you, you can file an identity theft report. If you’re in the US, you can do this online at IdentityTheft.gov or through designated public agencies elsewhere in the world.

How to protect yourself going forward

Here’s how to shift from a crisis response after a dark web alert to proactive protection:

Reduce the amount of personal info you share online

Often, we willingly overshare our personal details online. Be mindful of what you share on social media, limit what’s visible on your public profiles and delete any unused accounts. This helps to minimize your data exposure.

Use digital security tools to stay ahead of future breaches

Make it part of your data protection routine to use digital security tools for password management, dark web monitoring and identity protection. Many of these tools are free and available to anyone who wants to take their personal data security up a notch.

How Onerep helps you minimize online exposure

How do you take control of your personal data? The ultimate step is to remove it. This is where Onerep comes in, removing your personal details from 200+ people-search sites and data brokers, where it often appears without your knowledge, let alone consent. Removing it helps to limit the amount of data that could be leaked or used against you in social engineering attacks. The less data there is about you online, the less likely it is to trigger future dark web alerts.

FAQs

Why did I get a dark web alert?

You get a dark web alert when a monitoring service has found your personal data on the dark web. This can happen after a data breach, a leak or an unauthorized sale of your information.

What does ‘your info was found on a suspicious part of the web’ mean?

This phrase refers to the dark web, where personal data is often traded and is available to cybercriminals. If you get this notification, it can mean your data has been shared in a data breach dump, a hacker forum or listed for sale.

How do I know if my phone number or credit info is being used fraudulently?

If your phone number or credit card are being misused, you can get unexpected calls and texts, account verification codes you didn’t request, receive charges you didn’t make, see changes to your credit score, or receive debt collection calls for accounts or items you know nothing about.

How can I stop my data from appearing on the dark web again?

Start by removing your personal data from the internet using services like Onerep. Other recommended steps include using strong, unique passwords, two-factor authentication via a phone app, and being mindful of what you share on social media and generally online.

Dimitri is a tech entrepreneur and founder of Onerep, the first fully automated data removal service. Top cybersecurity CEO of 2021 by The Software Report.