Is Cash App safe? A 2025 deep dive into its security and risks

Cash App is a legitimate application that makes sending money between friends and family generally safe due to industry-standard security protocols such as data encryption and secure payment processing. However, the lack of purchase protection, limited customer support, and the potential for scams raise serious concerns about sending money to strangers.

Let’s look into how Cash App works and what you should do to ensure that your transactions are secure.

What is Cash App and how does it work?

Cash App is a peer-to-peer (P2P) service that allows fast money transfers between users. It’s designed as a mobile-first platform—while it’s available on desktop, the functionality is limited. That said, you can send and receive money both on your phone and computer.

To add money to your Cash App account, you can link your bank account or debit card. You can also make paper money deposits at retailers like 7 Eleven, Family Dollar, Kroger, and Walmart. Once funds are added to your account, you can send payments to anyone using their unique “$cashtag” (their Cash App ID), phone number, or email address.

To receive money, all you need to do is share your $cashtag with the sender. You can withdraw funds into your bank account or debit card. Alternatively, you can leave it in your Cash App balance to spend it in retail stores or on other Cash App services.

Sending and receiving money from your Cash App balance or linked debit card is fee-free. However, transferring money to a credit card incurs a 3% fee. Standard withdrawals (1-3 days) are also free, while instant deposits incur a 0.5% to 1.75% fee.

Cash App also offers additional services, including:

- Cash App Card: a debit card linked to your Cash App balance that allows you to pay in stores

- Investing: buy stocks using Cash App

- Bitcoin: purchase Bitcoin on Cash App

- Taxes: Cash App is an authorized IRS e-file provider and offers free tax filing

If you have the Cash App card, you can also take money out of ATMs. Withdrawing from in-network ATMs is fee-free, but there’s a $2.50 fee per transaction for out-of-network ATMs. It’s worth noting that after you make $300 or more in paycheck deposits in a month, Cash App gives you one free out-of-network ATM withdrawal.

How secure is Cash App?

Cash App implements the same security standards as other major financial platforms, but there are some important caveats to keep in mind.

Here are the app’s main security features:

Encryption and account protection

Cash App encrypts data when it’s being transmitted and stored, making it difficult for scammers to read it even if it were hacked. In addition, Cash App is PCI DSS compliant, meaning it adheres to credit card industry standards to protect your payment data.

The app also uses an algorithm to detect suspicious activity, requires confirmation to send money to new contacts, and notifies you if your security settings are changed.

Two-factor authentication and biometrics

Cash App helps prevent unauthorized access to user accounts with unique PINs and optional Touch ID, Face ID, and two-factor authentication.

FDIC insurance and SIPC protection

If you have a Cash App Card, your Cash App funds are federally insured up to $250,000. Note that certain conditions must be met.

If you buy stocks with Cash App, you’re covered by $500,000 in SIPC protection – but note that when you sell stocks, the funds go into your Cash App balance, which is not protected.

Admittedly, Cash App is not without its drawbacks, which are:

- Payments are final: on Cash App, payments are typically instant, final, and difficult to reverse. If you have a dispute, Cash App does not guarantee you can get your money back.

- Cash App is not a bank: so FDIC protection is limited to accounts that have the Cash App Card.

- Frequent scams: Scammers frequently target Cash App users, meaning you must be vigilant and careful about who you send money to when using the app.

- Data breaches: Cash App has been involved in data breaches, including a 2022 data breach that leaked the sensitive information of more than eight million users and another breach in 2023 that exposed data from even more users. Cash App was sued for their response, which resulted in a $15 million class action settlement and an agreement to strengthen its security measures.

Cash App vs. Venmo and Zelle

Like Cash App, Venmo secures accounts through encryption, biometrics, and two-factor authentication. However, unlike Cash App, Venmo also offers payment protection that allows users to get reimbursed if they don’t receive an order or if it arrives damaged.

Zelle is a little bit different in that it works with existing banking apps. That means it uses the same security technology as banks to protect payments. Zelle also offers two-factor authentication, but like Cash App, it does not offer purchase protection.

Does Cash App have buyer protection?

No, Cash App does not offer buyer protection. In fact, the company states that it cannot guarantee a refund if you don’t receive something you’ve paid for. However, you can take steps to try to get your money back if you think you’ve been scammed.

What happens if you get scammed?

If you believe you’ve been scammed, first try to cancel the payment. If that doesn’t work, you can report it to Cash App within 30 days of the original transaction:

- Log into your account and select the payment in question

- Tap the ellipses (…) in the top right corner and select “report an issue”

- Select “I was scammed” and follow the prompts

You can also call Cash App directly at 1-800-969-1940 or contact support via the app or social media.

Once you report a scam, Cash App says they’ll send an initial response and reference number. After investigating, they’ll issue a written decision, but they do not offer an exact timeline for resolution.

Refund and dispute limitations

Per Cash App’s Terms of Service, the company’s liability is limited to the greater of $500 or the fees they have collected from you during the three months preceding the event that caused you to make a claim.

The Cash App Card does offer a little more protection. If you report an authorized transaction within two business days, your liability is limited to $50. After two business days, it’s limited to $500.

When to use a credit card instead

In general, credit cards offer better protection against frauds such as unauthorized purchases. They can also offer additional benefits such as rewards points and building credit. Consider using a credit card instead of Cash App for:

- Buying online or from a brick-and-mortar business

- Purchasing big-ticket items

- If you want to earn rewards

- If you want to build credit

Cash App is secure for relatively small P2P transactions between friends and family members – individuals you know and trust.

Is Cash App safe to use with strangers?

When it comes to strangers, it’s better to take extra precautions. Since Cash App transactions are difficult to reverse, you want to make sure they’re trustworthy. We highly recommend only using Cash App with trusted friends and family members.

Common Cash App scams

- Customer support: Scammers impersonate Cash App customer support to get your login credentials, Cash App card number, or banking information

- Phishing & smishing: Emails and texts designed to steal your login and money or install malware on your device. Fake links lead to malicious spoofing websites that look like Cash App’s official site

- Fraudulent investments: Scammers promise massive returns on minimal investments – paid via Cash App – then disappear. This is also known as “cash flipping” or “money flipping”

- Charity scam: Fraudsters pose as charities soliciting donations, then take the money for themselves

- Deposit scam: Scammers impersonate rental property managers or landlords and require a deposit for properties they do not own or manage – or that might be altogether fake

- Screenshot scams: In this scam, a “buyer” will send a Photoshopped screenshot to “prove” they paid for an item

- “Accidental” payment: Scammers send money and claim it was an accident – they might message you and say it was meant for a friend – then request a refund. They paid you with a stolen credit card or Cash App account, but when you send the “refund,” they deposit it into their own account. Cash App might flag the original transaction and reverse it, and you lose money

- Job scam: Scammers send you an outstanding job offer, but you need to cover fees (such as for training or background checks) before you can start. There’s no job, and you’ve lost your money

- Catfishing: Scammers use fake identities and build romantic relationships online. Then, they start to ask for money via Cash App. For example, they might ask for help with bills, request gifts, or say they need help with travel expenses to visit you – but they never show up

- Sweepstakes scam: Cash App frequently holds sweepstakes on X with cash prizes. Scammers take advantage of this by impersonating Cash App on social media, inviting users to click a link and submit personal information to enter fake sweepstakes

Warning signs to watch out for

- Unsolicited messages: If you receive a message from Cash App you didn’t expect, never reply or click links. Instead, log into your account and contact support via their official channels to ensure it’s legit

- Personal information requests: Remember that Cash App won’t ask you for your login information, Social Security number, or credit card details to “verify” your account

- Requests from strangers: If you receive payment requests (or money) from strangers, it’s probably a scam

- Grammatical errors: If a message has misspellings, grammatical errors, or odd formatting, consider it highly suspicious

- Screenshots: Watch for screenshots posing as proof of payment as they may be photoshopped

- Improper URLs and email addresses: Always check email addresses and URLs to make sure they’re legit (but keep in mind that they can be spoofed). Scammers will create URLs and email addresses that look very similar to Cash App’s official ones. Official Cash App emails only come from email addresses ending in @cash.app, @square.com, or @squareup.com

- High pressure: If you “must act now” or lose the offer, it’s probably a scam. The same goes for offers that are too good to be true.

Cons of Cash App

While Cash App is convenient for P2P money sending and receiving, there are some cons to consider.

No purchase protection

Cash App doesn’t offer purchase protection, so if you buy a product and it doesn’t arrive, is damaged, or is missing pieces, you might not be able to get your money back.

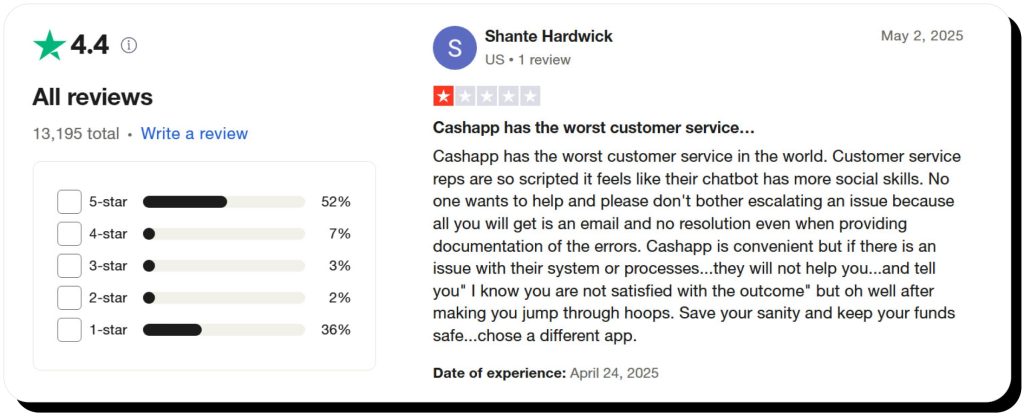

Weak customer support

Cash App’s support options are limited, and it’s often criticized for long resolution times, even for scams. Lack of customer support could give you pause when you’re dealing with your money.

Exposure to scams and fraud

Cash App users are often targeted in scams and fraud attempts. The app’s lack of buyer protection along with slow resolution times offers scammers greater ability to perpetrate fraud and get away with it.

Tips for using Cash App safely

Only send money to people you know

Only send money to people you trust – never to strangers. It’s also a good idea to verify you’re sending money to the right person. One common strategy is to send $1 first, then call the person to confirm they received it before sending a larger sum.

Verify recipient info

Always double-check – and even triple-check – that you’re sending funds to the correct $cashtag. You can confirm this with the recipient before sending money.

Enable security lock

Security Lock requires your PIN, Touch ID, or Face ID before sending money. This adds an extra layer of protection and ensures that if someone gets ahold of your phone, they can’t access your Cash App account.

Enable notifications

Set up notifications so you’re notified via text or email whenever a payment is sent. If you receive a notification for a payment you didn’t authorize, you can act fast before too much damage is done.

Use the Cash App Card

When you have the card, your Cash App funds are FDIC insured up to $250,000. Without the card, they’re not insured.

Use a strong PIN and 2FA

Always use a strong PIN and enable two-factor authentication to make it difficult or impossible for someone to access your Cash App account.

How Onerep helps protect your identity from fraudsters

You may have noticed that scams have become more personalized: emails start with your full name, unsolicited callers know what services you use, and you may even receive “accidental” payments to your financial accounts.

One reason behind this is data brokers. These sites collect your personal information from various sources and then publish it online for anyone to find. They expose your address, phone number, email address, place of work, income, assets, and other sensitive details that help scammers target you with phishing messages, guess answers to security questions for important accounts, and impersonate an entity you trust.

Onerep helps you protect yourself by removing your personal information from over 200 data broker sites. The service scans data brokers for your details, then sends opt-out requests on your behalf. Even after your info is deleted, Onerep regularly rescans the sites to make sure your data isn’t republished.

That way, scammers can’t access your personal details, significantly decreasing the likelihood you’ll be targeted in Cash App and other scams.

FAQs

Can Cash App be hacked?

Yes, Cash App – like any online platform and app – can potentially be hacked, and Cash App has been involved in data breaches. That said, Cash App does implement industry-standard security, and it’s not more likely to be hacked than other platforms.

What are the risks of using Cash App?

The primary risks of using Cash App are lack of payment protection, weak customer support, and potential exposure to scams. Cash App doesn’t guarantee you can get your money back if you are scammed.

How safe is Cash App?

Cash App employs security features such as encrypted data and credit card payment protection. You can also enable Security Lock to verify each payment before it’s sent. Still, Cash App is safest when used with trusted friends and families, not strangers.

Does Cash App have buyer protection?

No, Cash App does not have buyer protection. However, you can try to cancel payments and Cash App will investigate if you report scams. That said, there is no guarantee you will get your money back. Note that Cash App Card users do have some protection: if you report a fraudulent transaction within two business days, your liability is limited to $50. After two days, it’s limited to $500.

How do I get my money back if I was scammed?

Contact Cash App support immediately via the app or social media, or by calling 1 (800) 969-1940 between 8 a.m. and 9:30 p.m. ET. You can also see if it’s possible to cancel your payment in the app. Note that most Cash App payments are instant and Cash App does not offer any guarantees you can get your money back.

Is Cash App safe to use for business transactions?

Cash App is as safe to use for business transactions as it is for P2P transactions. Cash App does verify business identities, but the same risks can apply. We recommend only using Cash App to pay small business owners you personally know. Use a credit card or other payment method with purchase protection for larger businesses and online shopping.

Is Cash App safe to receive money from strangers?

If strangers send you money on Cash App – especially payments that are random or otherwise unexpected – they could be attempting to scam you.

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.