Is Identity Guard legit? A 2025 breakdown of features and user reviews

Identity Guard is a legitimate service for identity theft protection, owned by the digital security company Aura. Even the most basic subscription plan provides AI-powered dark web monitoring, safe web browsing tools, and up to $1M in identity theft insurance. Advanced plans include additional protections like bank account and credit monitoring that are essential for high-risk individuals.

What is Identity Guard?

Identity Guard is a subscription-based service that provides identity theft protection by monitoring your personal and financial information for signs of fraud or unauthorized use. It scans the dark web, data brokers, financial databases, and other sources online for exposed details like Social Security numbers, bank account info, or credit card info. When it detects suspicious activity, Identity Guard sends you alerts and connects you with recovery specialists. All plans include up to $1 million in identity theft insurance and security tools like a password manager and safe browsing features, with premium plans also offering credit monitoring from the three major bureaus.

Identity Guard was founded in 1996 by Intersections Inc., one of the early pioneers in consumer credit and identity protection services in the United States. In 2019, it was acquired by Aura, a digital security company that consolidates cybersecurity, privacy, and identity protection tools under one umbrella.

Identity Guard is designed for anyone who wants proactive protection against identity theft and financial fraud—individuals, businesses, and families. However, the service will be most valuable for those with a moderate-to-high online footprint or previous exposure to data breaches.

How does Identity Guard work?

Identity Guard has earned a reputation for being relatively easy for the average person to use. Once you subscribe, you’ll need to fill out a form with personal information such as your name, DOB, address, SSN, and contact details. This info is used to set up the account and monitor the web for exposure.

Depending on your plan, the company provides the following features:

Dark web monitoring

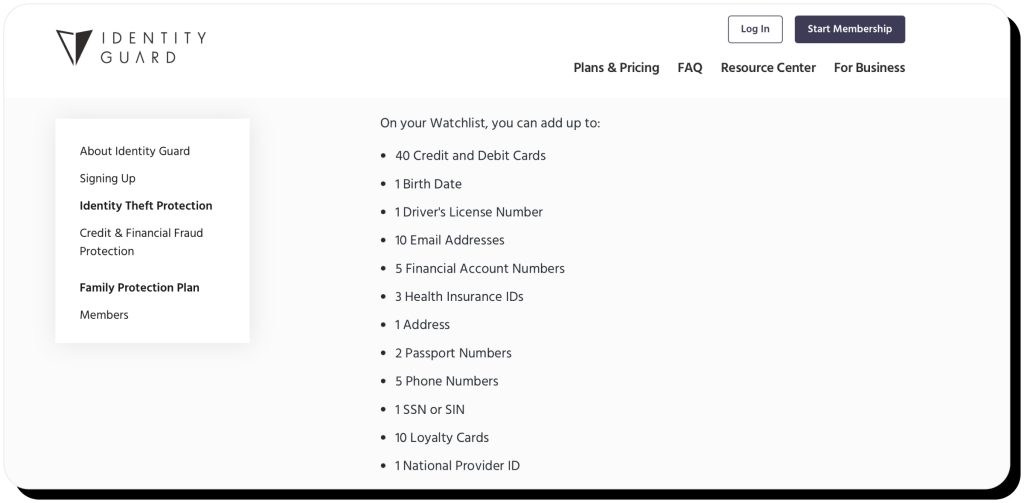

Using AI tools, Identity Guard scans the dark web for leaks of your personal information. The scan isn’t limited to the details you provide upon sign-up—you can add more data, including credit cards, driver’s license numbers, financial account numbers, health insurance IDs, passport numbers, and more. If any of these details are found exposed, Identity Guard sends you alerts so that you can take appropriate steps to protect your identity and finances.

Identity theft insurance

In case your identity is stolen, Identity Guard offers up to $1 million in insurance to cover the financial impact (costs associated with recovering your identity and fixing the damage).

Credit monitoring

Identity Guard monitors your credit activity and alerts you to any new credit inquiries, account openings, or major score changes that could indicate fraudulent activity. You will also get access to monthly credit scores and annual credit reports.

Bank account monitoring

Users can add up to 5 financial account numbers and 40 debit or credit card numbers to their Watchlist. Identity Guard will alert you if it detects unusual withdrawals, spending spikes, or account changes that could signal theft or fraud.

Social media monitoring

Premium users can connect social media accounts (such as Instagram and Facebook) so that Identity Guard monitors for unusual activity, fake profiles, and malicious links. Importantly, the service doesn’t monitor personal messages.

Criminal activity monitoring

Identity Guard checks if your personal information is linked to criminal records or sex offender registries. This helps detect situations where identity thieves use stolen personal data to commit crimes, potentially leading to false legal associations under your name.

Safe browsing

When you browse the web with the Identity Guard browser extension, it can block ads, prevent tracking, and identify potentially malicious links. It also warns of scam sites that could expose you to phishing and social engineering.

Password manager

Identity Guard has a password manager, which can help keep your passwords organized in a secure location. It also offers advice on password strength, which is helpful for users who are less familiar with cybersecurity standards.

White glove fraud resolution

In case your identity is stolen, you’ll get access to a dedicated case manager who assists with everything from disputing fraudulent accounts to filing reports and recovering stolen funds.

Is Identity Guard safe to use?

Identity Guard is generally considered safe to use:

- It’s backed by Aura, a reputable cybersecurity company that follows industry standards for data protection.

- It uses AES-256-bit encryption to secure all user information (the same encryption is used by banks and government institutions).

- It complies with U.S. security and privacy standards (such as the California Consumer Privacy Act) and maintains transparent data-handling practices.

As for handling user data, Identity Guard doesn’t sell personal information to third parties. While the service does share some data, it’s typically limited to what’s needed to operate the service.

Is Identity Guard worth it?

Whether Identity Guard is worth it depends on your needs. The service certainly has a good offering both for those who want basic monitoring and those at higher risk of identity theft. However, some alternatives offer more features for the same price as Identity Guard’s cheapest plan.

Overall, Identity Guard is most beneficial for users with a strong online presence and multiple financial accounts.

Digging into Identity Guard reviews online

Identity Guard is often considered one of the best identity theft protection services available for businesses and individuals, but what do its users say?

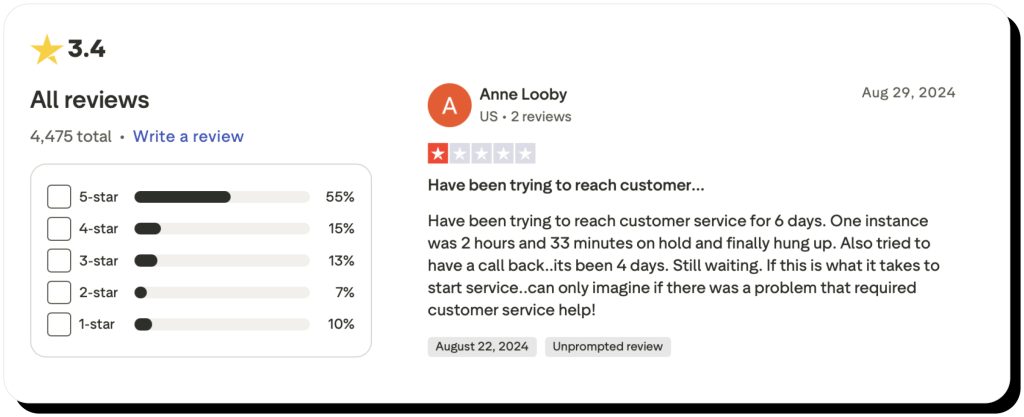

The opinions online seem to be mixed.

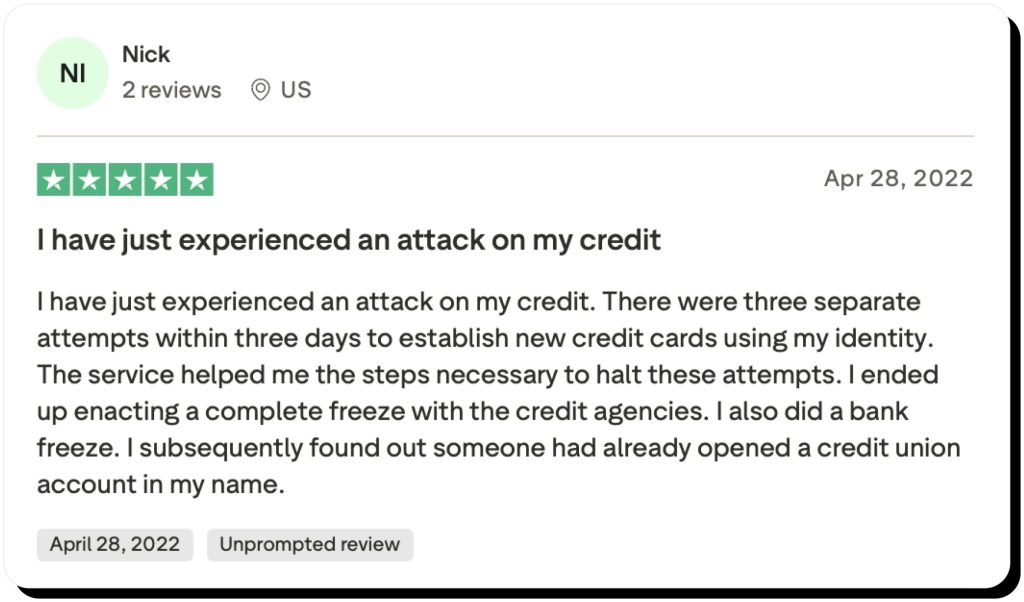

On one hand, many customers say that the service is easy to set up and helps detect unauthorized activity.

On the other hand, many Identity Guard complaints mention issues with billing and account cancellation. Moreover, many users say they were charged more than expected with no prior notice.

On platforms like Trustpilot, Identity Guard seems to be responsive, looking into reviews and offering resolutions. At the same time, many people claim that the support team is hard to reach and doesn’t provide timely help.

Identity Guard cost: price breakdown by plan

Value (basic identity protection)

This is the cheapest Identity Guard plan that provides basic protection:

- Data breach alerts

- Dark web monitoring

- Password manager

- Safe web browsing

- $1M identity theft insurance

Individual monthly subscription costs $8.99 and the yearly one currently comes down to $7.50/mo. The family subscription allows adding up to 5 adults and an unlimited number of children and costs $14.99 monthly. The yearly family plan currently comes down to $12.50/mo.

Total (standard identity and credit protection)

This plan costs $19.99/mo for individuals and $29.99/mo for families. Yearly subscriptions come down to $16.67 and $25, respectively.

The Total plan includes everything Value does, plus:

- Bank account monitoring

- 3-bureau credit monitoring

- Monthly credit score updates

Ultra (premium identity and credit protection)

This one is the most comprehensive (and expensive) plan Identity Guard offers. In addition to features available in other plans, it provides:

- Social media monitoring

- 3-bureau annual credit report

- Credit and debit card monitoring

- Criminal offense monitoring

- USPS address change notifications

- White glove fraud resolution

Ultra costs $29.99 monthly for individuals and $39.99 for families. Yearly subscription comes down to $25 and $33.33, respectively.

Alternatives to Identity Guard

There are free and paid identity protection tools available online, many of which are viable alternatives to Identity Guard. While each platform is different, the end goals are basically the same: to identify any compromised personal or financial information and make customers aware of potential security issues.

LifeLock

LifeLock is a comprehensive identity protection service that offers similar features to Identity Guard. While LifeLock is a bit pricier, its Ultimate plans offer more in insurance and provide unique features like stolen wallet protection and phone takeover monitoring. Additionally, LifeLock is owned by Norton, which lets them offer device security and privacy protection features like a VPN, parental controls, and virus protection. On the other hand, its family plan includes only 2 adults.

IdentityForce

Owned by TransUnion, IdentityForce focuses on credit monitoring. Like Identity Guard, it provides dark web monitoring and identity theft insurance. However, it also offers a VPN and online PC protection. Moreover, the more expensive plan offers daily TransUnion credit reports and scores, quarterly 3-bureau reports, and phishing monitoring. However, its family plan also includes only 2 adults.

Aura

The parent company of Identity Guard, Aura, has a reputation for being one of the most versatile identity theft protection tools around. It goes a step further than Identity Guard by also offering parental controls, spam call/text protection, antivirus, and even cyberbullying alerts. Aura’s plans aren’t based on features, but on the number of users (individual/ couple/ family). Overall, it’s a great choice for those who want a complete cybersecurity suite, not just monitoring.

Credit Karma or Experian

If you’re looking only for credit monitoring, then Credit Karma and Experian might be the best choice as both offer it for free. Credit Karma provides free credit score tracking, credit report updates, and personalized financial recommendations, helping users monitor their credit health and find products like loans and credit cards. Experian, one of the three major credit bureaus, offers free credit reports and score tracking, with optional paid plans that include credit locks and identity theft insurance. It’s important to note, however, that people at a higher risk of identity theft may not receive the level of protection needed from these free services.

Final verdict

Identity Guard is a legitimate identity protection service that’s been around for almost 30 years. Its affiliation with Aura (an established name in cybersecurity) and commitment to privacy and security make it a trusted choice for fraud prevention.

If you are looking for basic monitoring, you may be better off with a free service. However, Identity Guard is worth it for businesses and individuals who want a more comprehensive identity theft prevention tool. It’s not the cheapest service of its kind, but it offers a reasonable amount of features and services for the cost.

FAQs

Does Identity Guard protect your Social Security number?

Identity Guard can’t protect your Social Security number from being breached (no service can do that). What it does is scan the web (including the dark web) and alert you if your SSN has been leaked or found in a suspicious context (such as new account openings). It can’t prevent criminals from using your SSN but it helps you detect fraud and act quickly.

How much does Identity Guard cost per month?

Identity Guard offers 3 plans: Basic Identity Protection costs $8.99/mo ($14.99 for families), Standard Identity & Credit Protection costs $19.99/mo ($29.99 for families), and Premium Identity & Credit Protection costs $29.99/mo ($39.99 for families). Family plans allow adding up to 5 adults and unlimited children.

Can Identity Guard prevent identity theft?

Identity Guard can prevent identity theft in the sense that it can help you detect if your personal information has been leaked and take measures to prevent its misuse. In case you experience identity theft, you’re covered by the service’s insurance of up to $1M per account. However, Identity Guard can’t prevent identity theft in the sense that it can’t fully stop criminals from using your personal info if they access it (no service can).

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.