Apple Pay scams: how to spot and avoid them

Apple Pay has redefined how convenient and fast payments can be, but it has also become a lucrative opportunity for scammers to prey on Apple customers.

In recent years, fraudsters have found clever ways to exploit the popularity of Apple Pay—not only by hacking Apple accounts but also by manipulating people. Apple Pay scams often use social engineering tricks to make victims believe they’re talking to a legitimate business representative, including Apple Support, and to convince them to transfer money or share sensitive information.

Learn how to keep your guard up and avoid falling for common Apple Pay scams in the following guide on the types of scams, their red flags, and what you can do to mitigate the risks and losses, if you ever become a victim.

What is Apple Pay and why is it targeted by scammers?

Apple Pay is a mobile wallet and payment system by Apple, Inc. that allows users to make purchases in stores, apps, and online using Apple devices. It works through near-field communication (NFC) for in-person payments and encrypted credentials when paying online.

But can you get scammed with Apple Pay? Yes, you can. Scammers are drawn to Apple Pay for several reasons:

- It’s highly trusted by its huge user base. In the U.S. alone, there are currently over 60 million users, and this number is poised to grow to 84 million by 2030. Apple is known for its loyal, well-to-do customers who are likely to trust Apple-related messages and can be a lucrative target.

- There’s perceived safety associated with Apple devices, so users may lower their guard, believing Apple Pay is foolproof.

- Apple Pay transactions are instant, and once money is sent, it can be difficult to recover.

- Apple Cash, a P2P money transfer offshoot of Apple Pay, is another gateway for scammers to defraud Apple Pay users.

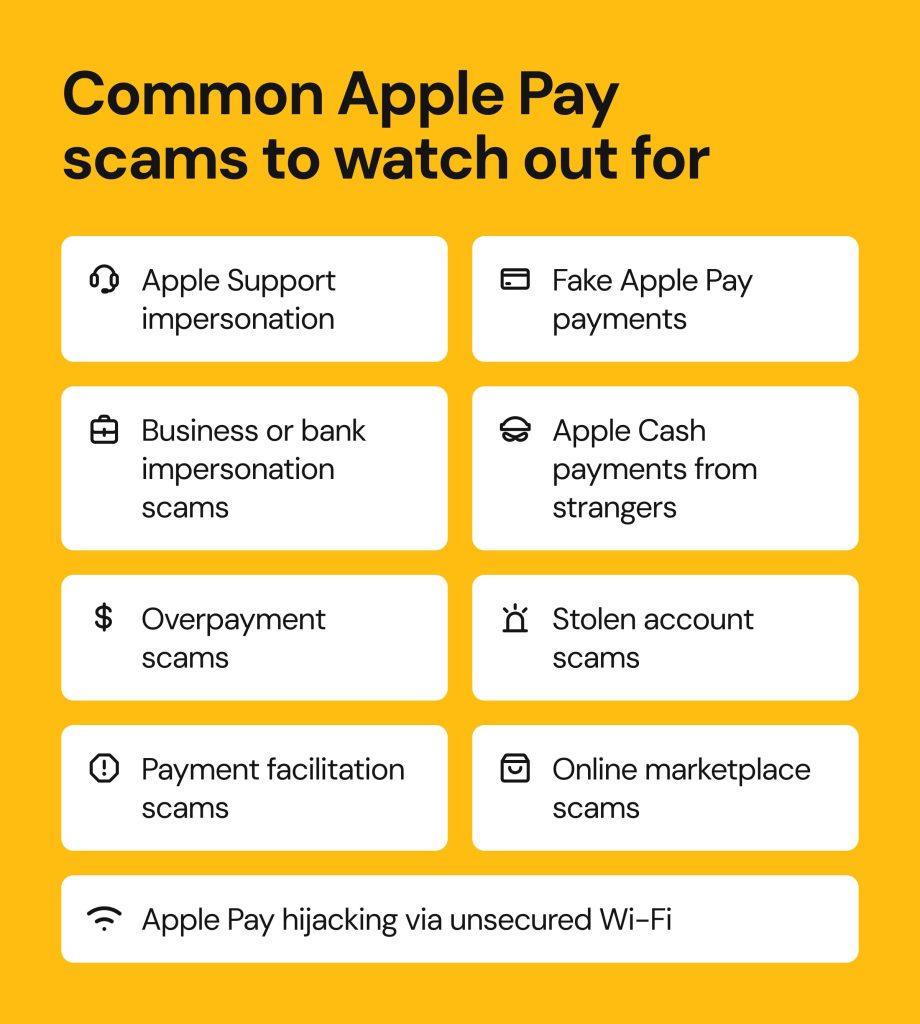

Common Apple Pay scams to watch out for

While Apple Pay has strong security features, scammers have found their way around them by manipulating people into sending money and sharing sensitive information. Many of these scams appear legitimate on the surface and can happen quickly, especially when you don’t expect it.

Apple Support impersonation

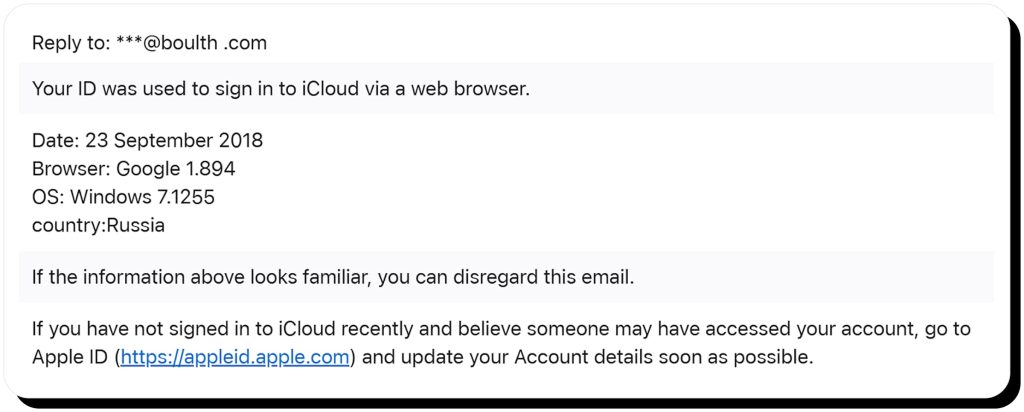

Apple is in the top ten most impersonated companies, according to the FTC report. Exploiting Apple users’ trust and reliance on messages from the brand, scammers impersonate Apple Support and send out phishing emails and text messages. These may alert users about a problem with their account, payment, or Apple Pay itself, and ask them to “verify” their identity or transaction by clicking the provided link. The link leads to a fake website that steals the information entered, likely Apple Pay credentials or credit card data.

Apple Support impersonators use various scenarios, for example:

- Alerting you to a suspicious activity with your account, like a new login, and including a phishing link in the email to steal your Apple account credentials.

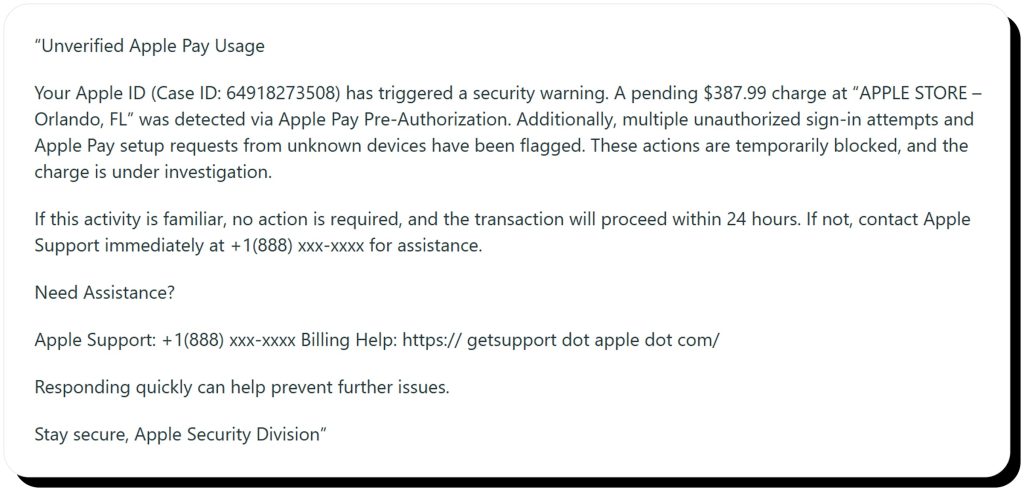

- Claiming your Apple Pay account has been locked and needs verification.

- Asking you to send a “test payment” to check your device or account.

- Sending emails that look like Apple Pay receipts but include fake support links.

- Asking for your Apple ID password or two-factor authentication code.

- Requesting that you install screen-sharing software to grant them access to your device remotely, which enables them to install malware or steal sensitive information stored there.

You can tell a fake Apple Pay support message from a legitimate one by its urgent or threatening tone and requests for personal information, Apple account credentials, or a verification code. A common trick is prompting you to call the number provided in the message to cancel the “transaction,” a form of refund scam also used by Best Buy’s Geek Squad impersonators.

Business or bank impersonation scams

Scammers use names and associated phone numbers found online to target people in impersonation scams. Pretending to be from your bank, the IRS, or another government agency, they may use pressure tactics and threaten immediate legal action unless you pay a certain amount via Apple Pay or buy an Apple gift card for them. In some cases, they may invent a story to make you share your sensitive information, such as your Social Security number, which they may later use to steal your identity and apply for loans in your name.

To prevent impersonators from reaching you, check if your personal contact details are online. Onerep is one such service automatically removing your personal records from 200+ public data brokers and people-search websites. Give it a try for free now.

Fake Apple Pay payments

Scammers target sellers on marketplaces and resale platforms like OfferUp or Craigslist, pretending to pay and sharing a fake Apple Pay image confirmation or screenshot. The seller, believing they’ve been paid, ships the item only to find out later that no money was ever transferred.

If you ever decide to resell an item through an online marketplace, watch out for buyers pressuring you to use Apple Pay, sending image-based payment confirmations, claiming that Apple Pay is still “processing” the transaction, and demanding that you ship the item early.

Apple Cash payments from strangers

As an instant money transfer service built into Apple Pay, Apple Cash is a frequent target of scammers, who use similar techniques to those also found in Zelle scams or Cash App scams.

Using stolen credit card data, scammers set up fake Apple Pay accounts and send stolen funds to strangers via Apple Cash.

There are several goals behind this Apple Pay fraud:

- Scammers can use their victims as “money mules”—transferring stolen or fraudulently obtained funds to their accounts via innocent people.

- It’s part of a larger scam, where bad actors use the accidental payment as a conversation starter to talk the target into investing in a fraudulent trading scheme, like in pig butchering scams.

Either way, it’s advised to avoid accepting Apple Cash payments from strangers automatically by setting up manual review of incoming money transfers via Apple Cash. If you do receive an unexpected sum of money from a stranger, don’t spend it—report the transaction (see below).

Overpayment scams

Overpayment is a common tactic used by scammers across platforms and payment services, especially those that rely on in-app messages. Pretending to buy an item from you, the scammer will “accidentally” send you a larger sum of money and ask you to refund the difference using another payment method. In some cases, they provide only screenshots as payment confirmation, asking you to send them back the difference.

In reality, they use a stolen credit card or hijacked Apple Pay account to send funds that will later be reversed as fraudulent. If you send back any money, it will come out of your pocket.

Apple Pay hijacking via unsecured Wi-Fi

Scammers can intercept data via public unsecured Wi-Fi networks. If you use Apple Pay while connected to such a network without encryption, bad actors may view your activity or inject malicious prompts to steal your Apple Pay login credentials. In a combined phishing attack, you could be redirected to a fake login page designed to steal the credentials you enter.

Avoid using Apple Pay and other sensitive services over public networks that don’t require passwords, and watch out for suspicious login prompts while browsing or managing Apple devices.

Stolen account scams

Scammers can also hijack Apple Pay accounts using stolen credentials and phishing messages to capture verification codes. Once they take over an Apple Pay account, they can use it to make unauthorized purchases and transactions, and target the victim’s contacts with additional scam requests.

Similarly, you may be contacted by scammers impersonating your friends or known contacts using stolen information, spoofed phone numbers, and fabricated stories to convince you they need money urgently.

You should regularly monitor your Apple Pay activity for any signs of transactions you don’t recognize, messages from your account that you didn’t send, or being locked out of your Apple ID.

Payment facilitation scams

Someone may approach you asking for help to transfer money to someone else. They may suggest using your Apple Pay account while they write you a check to cover the transaction amount. This is a common type of Apple Pay fraud that uses fake checks, which later bounce, leaving you, the money sender, at a loss.

Online marketplace scams

Scammers post fake listings on popular online marketplaces, setting low prices for high-demand items or property, and ask for advance payments—either in full or partially as a deposit. Fraudulent online sellers may persuade you to buy something you haven’t seen via Apple Cash. Just like in the case of Facebook Marketplace scams or OfferUp scams, you might be unable to get your money back if you didn’t receive the item but already paid for it outside the platform.

How secure is Apple Pay?

Apple Pay is considered a highly secure mobile payment method, but like with any technology, there are limitations and loopholes, often related to the human factor, that scammers can exploit.

By default, Apple Pay uses tokenization and data encryption, which replaces your real credit card with a unique encrypted token used for money exchange between you and the merchant. On top of that, biometric authentication such as Face ID or Touch ID adds another layer of protection. Learn more in our guide to Apple Pay safety.

However, no system is completely immune to scams and fraud. Apple Pay scammers often succeed not because of faulty technology but due to people’s innate fallibility, poor online security habits, and lack of vigilance.

People assume that any communication coming from Apple is legitimate and tend to act hastily when they think their Apple device or account is at risk. Some users don’t know that Apple Pay and Apple Cash transactions are instant and irreversible, and may believe scammers who present them with fake payment confirmations. All these factors add up, leading to financial losses and identity theft risks for those who rely on Apple’s security alone without learning to recognize and avoid scams.

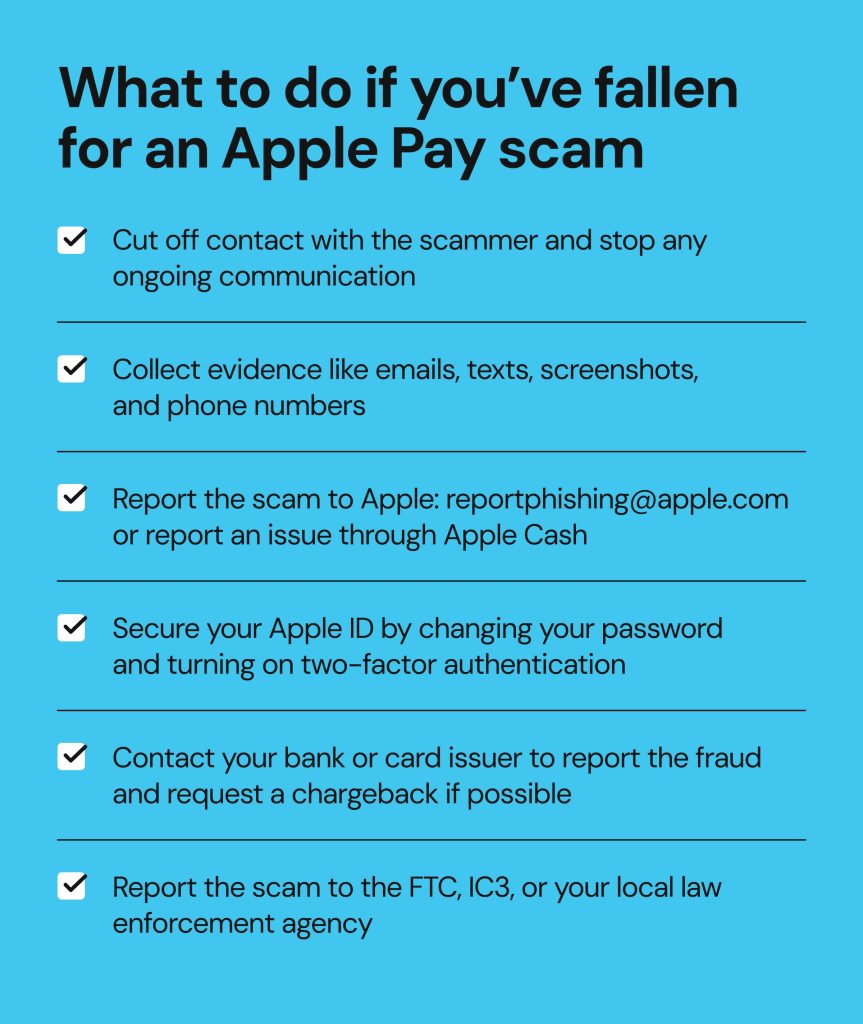

What to do if you’ve fallen for an Apple Pay scam

If you’ve fallen for an Apple Pay scam, stop all communication with the scammer first. You should also collect evidence, such as emails and text messages from scammers showing their email address and caller ID, to use in your scam report.

Report the scam to Apple

If you received a phishing email, forward it as an attachment to reportphishing@apple.com, take screenshots of the email as evidence, and delete it from your inbox.

If you’ve been scammed when using Apple Cash, tap on the transaction and choose Report an Issue.

If your Apple ID or device has been compromised and you’re locked out of your account, contact Apple Support.

Contact your bank or payment card provider

Unless you use Apple Card, if you transferred money to the scammer using Apple Pay or Apple Cash, you should contact your card issuer, not Apple.

Apple Pay is only an intermediate layer between your payment card provider and the recipient. This means you can’t directly reverse Apple Pay or Apple Cash transactions, and all disputes and transaction cancellations should be handled via your bank or payment card issuer. Contact them using the phone number on the back of your card, explain that you’ve been scammed, and request chargeback if possible.

If you use Apple Card:

You can dispute an Apple Card transaction directly with Apple by reporting an issue with the transaction. Follow these instructions to access and complete the transaction dispute form, which will then be reviewed by Goldman Sachs, the bank issuing Apple Cards. You can also report a compromised card and request a replacement.

Secure your account

If you believe your Apple account has been compromised, immediately change your password and ensure two-factor authentication is enabled. If you can’t access your account because someone else changed it without your knowing, reset your password.

Report the scam to authorities

If you’re in the U.S., you can report the scam to the Federal Trade Commission and the Internet Crime Complaint Center. You can also report it to your local law enforcement agency.

Tips to stay safe while using Apple Pay

Your ability to stay safe when using Apple Pay largely depends on raising your security awareness and learning to protect your Apple Account. Here’s how to do this effectively.

Learn to recognize red flags:

- Check if the caller ID matches the company they claim to be from. If the call sounds suspicious, hang up and contact the company directly via their official contact channel.

- Spot any signs of urgency or alarmist behavior designed to make you act fast without much thinking.

- Stay cautious if someone asks you for your personal information (such as your Social Security number or credit card number) and account credentials, and never share these sensitive details with anyone.

- If someone claiming to be from Apple Support asks you to disable your security features, such as two-factor or biometric authentication, don’t do it—it’s a scam.

- If you receive a message or email allegedly from Apple Support that contains a phone number to call, verify whether it’s legitimate for your location via Apple’s support portal.

- Double-check that the login page you’re prompted to visit matches Apple’s legitimate web address, branding, and layout. To protect yourself from phishing, don’t click on links or download attachments in suspicious or unsolicited emails and text messages.

- If it sounds like a scam, assume it is and stop interacting.

Adopt secure practices:

- Turn on two-factor authentication and biometric authentication (Face ID or Touch ID) across your Apple devices.

- Enable Stolen Device Protection on iPhone so that even if your device is stolen by someone who knows your passcode, they can’t make changes or exploit your Apple Pay account.

- Consider using a physical security key that acts as another layer of protection instead of digital verification codes, which can be intercepted.

- Use Apple Cash only with people you know and trust, as there’s no buyer protection or reversibility of transactions.

- Change your Apple Cash settings to accept payments manually instead of automatically, allowing you to review and approve only payments you recognize.

- Never pay anyone with Apple gift cards.

- If someone online demands payment via Apple Pay, pause and think—if you wouldn’t hand them physical cash in real life, don’t pay them online.

- When someone claiming to be from a business or the government agency contacts you unsolicited and requests an Apple Pay payment, stop communication and verify their request independently.

- Never share your personal information, account credentials, or verification codes with anyone, even if they claim to be from Apple Support. If in doubt, contact Apple via their official support channels.

- Remember that the real Apple will never ask for your Apple account credentials, verification codes, passwords, or Apple Cash payments.

FAQs

What are the warning signs of an Apple Pay scam?

Some of the signs of Apple Pay scams include unsolicited messages and calls from someone claiming to be from Apple Support or your bank, requests to pay via Apple Pay or Apple gift cards, pressure to act quickly, suspicious links and attachments, and unexpected Apple Cash transfers from strangers.

How can I protect myself from Apple Pay scams?

Securing your Apple Account is key. Use strong passwords, two-factor and biometric authentication, and never share your credentials or security codes with anyone. You should also stay cautious when contacted out of the blue with requests for payments or personal information.

How to get money back from Apple Pay if scammed?

Apple can only provide assistance via Goldman Sachs if you use Apple Card. In other cases, you should contact your payment card issuer to report the scam and initiate a transaction reversal, if available.

Does Apple Pay have buyer protection?

No, Apple Pay doesn’t provide buyer protection. Apple Pay is only a mobile wallet serving as an intermediate between you and the merchant. In case of a dispute, you should request a refund from the merchant or attempt tp reverse the transaction by contacting your bank.

Can Apple Pay be hacked?

Apple Pay itself is very difficult to hack, but your account can be compromised if bad actors manage to obtain your account credentials and security code through social engineering and manipulation.

Dimitri is a tech entrepreneur and founder of Onerep, the first fully automated data removal service. Top cybersecurity CEO of 2021 by The Software Report.