Is Kroll Monitoring legit? A 2025 guide to credibility and security measures

Kroll Monitoring is a legitimate business that’s typically hired by other companies to protect customer identities after a data breach. For example, if an online retailer you’ve bought from gets hacked, the store might bring in Kroll Monitoring to monitor and, if needed, restore your identity.

Many Fortune 500 companies trust Kroll Monitoring to provide identity monitoring and restoration services, and the company follows strict security standards designed to protect your data. However, mixed reviews and Kroll’s own 2023 data breach might give you pause before enrolling.

Read our Kroll Monitoring review to see how it works, whether it’s safe, popular alternatives, and our final verdict on whether you should trust Kroll Monitoring.

What is Kroll Monitoring?

Kroll Monitoring is an identity theft protection and fraud recovery service provided by Kroll, a global risk advisory firm. It’s not available directly to consumers; instead, companies hire Kroll to notify and protect customers who have been affected by data breaches.

For example, you might receive a letter from a retailer you shopped at stating your information was involved in a data breach and that they are paying for Kroll Monitoring on your behalf to help prevent or mitigate damages. Your notice will likely include a member number with instructions to visit Kroll’s enrollment page.

After enrollment, you’ll receive:

- Consultations with experts who can help determine whether you’re an identity theft victim

- Ongoing monitoring for suspicious activity, including dark web and credit report scans

- Fraud, scam, and identity theft alerts

- Identity restoration services, if needed

Kroll Monitoring also includes a dashboard you can log into to view your account.

Is Kroll a legitimate company?

Yes, Kroll is a legitimate company originally founded in 1972 by Jules Kroll, then acquired by Duff & Phelps in 2018. Duff & Phelps was founded in 1932 and rebranded as Kroll in 2021. Today, the company has a global presence with locations in North America, Latin America, the Caribbean, Europe, the Middle East, Africa, and the Asia Pacific.

Other trust signals include:

- Kroll has decades of experience in risk management and is trusted by many Fortune 500 companies, government entities, and financial institutions.

- Kroll LLC is accredited by CREST, an international accreditation body for penetration testing and cybersecurity service providers.

- Some Kroll entities hold private investigator licenses in multiple U.S. states.

- Kroll’s clients include 95% of Am Law 100 law firms, 24 of the 25 largest private equity firms in the PEI 300, 21 of the 25 largest hedge fund companies, and 72% of Fortune 100 companies.

- The company has consistently earned recognition from organizations like Global Arbitration Review, Hedgeweek, Private Equity Wire, Lexology Index, Global Investigations Review, Chambers and Partners, and Bloomberg.

How Kroll Monitoring works

Kroll Monitoring monitors your credit for new inquiries and opened lines of credit. It also scours the web for your personally identifiable information (PII) to find data not reported by credit bureaus. This includes instances of your Social Security number, bank account info, credit cards, medical IDs, and contact information appearing in public records and dark web marketplaces.

If Kroll suspects a problem, you’ll be notified instantly. Then, you can review the issue on your dashboard and take remedial action if necessary. You can also call Kroll’s private investigators (PIs) for assistance.

Kroll’s PIs can:

- Investigate fraud

- Issue fraud alerts with the major credit bureaus and government entities

- Prepare dispute letters and other documentation on your behalf

- Guide you through identity restoration

Live support from licensed PIs is one reason major companies hire Kroll to protect their customers’ identities after known data breaches.

Is Kroll Monitoring safe to use?

Yes, Kroll Monitoring is generally considered safe to use based on the following:

- Transport Layer Security (TLS) authentication, ensuring sensitive information is encrypted in transit and at rest

- PCI-DSS compliance, which means Kroll Monitoring follows major credit card industry security standards

- Adherence to federal consumer protection laws, including the Fair and Accurate Credit Transactions Act (FACTA), the Fair Credit Reporting Act (FCRA), and the Gramm-Leach-Bliley Act (GLBA)

- HIPAA compliance, meaning Kroll follows laws designed to protect health information

- SOC Type 2 Certification, which means Kroll’s privacy, security, and data handling practices have been independently audited

A common user concern is why you should give Kroll Monitoring more of your personal information after a data breach. The answer is that Kroll only collects personal details that are necessary for monitoring, and it follows best practices to protect that data.

That said, it’s important to understand that no monitoring service can guarantee 100% prevention of identity theft, especially when your information has already been leaked.

FTX Creditors data breach and class-action lawsuit

In 2023, a hacker gained access to Kroll’s cloud services by using a sophisticated SIM-swapping attack in which the hacker convinced T-Mobile to transfer a Kroll employee’s phone number to their own phone. Then, the hacker was able to use it to access Kroll’s cloud server and sensitive FTX data, including customer names, addresses, contact information, and account balances, which were subsequently used to launch phishing attacks against FTX customers.

In 2025, FTX customers filed a class-action lawsuit against Kroll over monetary damages related to the breach and phishing scams. Even though passwords were not exposed, hackers were still able to use the leaked data to attempt to scam unwitting victims, underscoring the fact that no service should be considered completely foolproof against data breaches.

Kroll Monitoring reviews and reputation

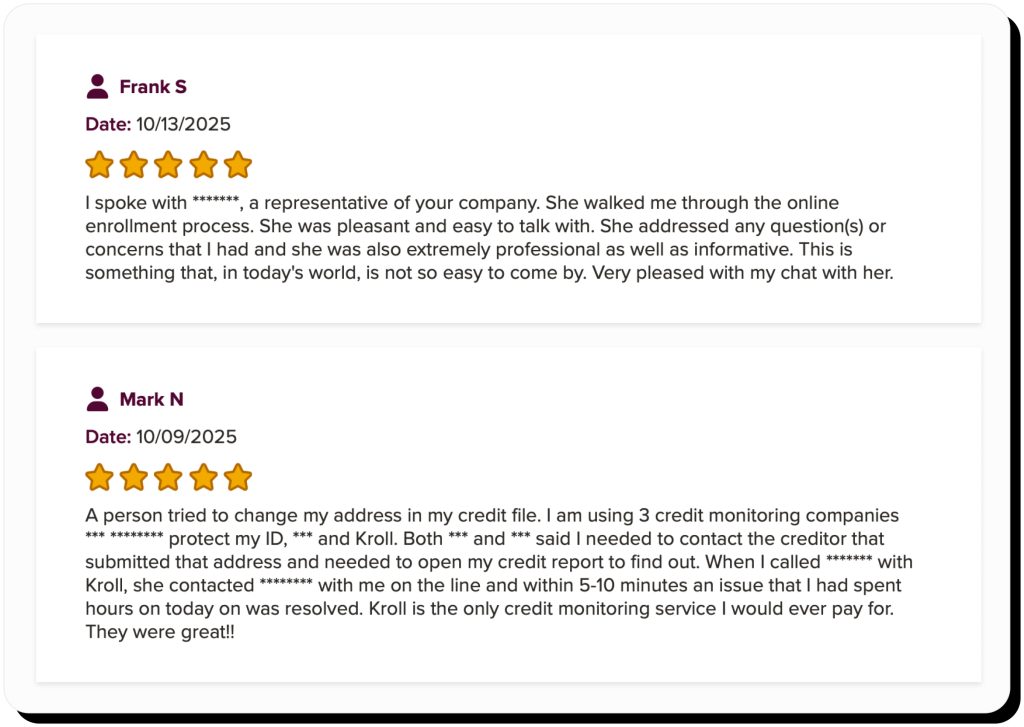

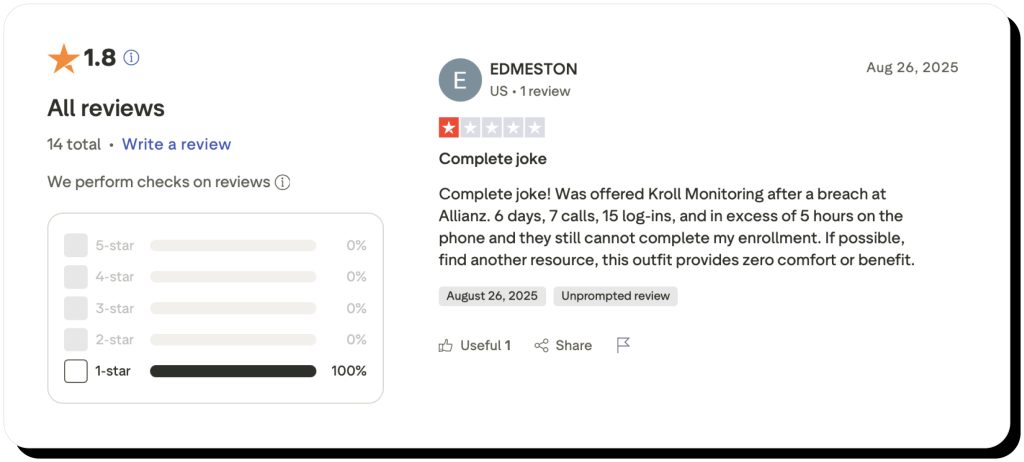

Kroll is accredited by the Better Business Bureau, currently holding a “B” grade and a 3.51-star rating out of more than 270 customer reviews. Over the past three years, Kroll has over 185 complaints, and at the time of this writing, just 84 were closed. BBB reviews are mixed: some reviewers express displeasure over long wait times and a lack of support, while many recent reviews state that Kroll’s customer service representatives are friendly and helpful.

Kroll doesn’t fare well on Trustpilot, where (at the time of this writing) the company has a 1.8-star rating – though from just 14 reviews. Most of the reviewers cite difficult enrollment, poor customer service with long wait times, and low effort as reasons for their poor feedback.

However, it’s important to note that Kroll Monitoring has handled identity monitoring for thousands of people over the years. In perspective, the reviewers on BBB and Trustpilot are only a small fraction of its total user base. That doesn’t mean the complaints should be ignored, but they should be weighed against the scale of Kroll’s operations and the fact that most users never need to contact support or post a review once their monitoring runs smoothly and uneventfully.

Pros and cons of Kroll Monitoring

Pros

- Ongoing monitoring: Kroll monitors non-credit data to identify potential breaches that typical credit monitoring could miss.

- Expert assistance: Kroll experts – including licensed private investigators – can help restore your identity if you’re a victim of identity theft.

- Free: Kroll is typically paid for by whichever company was subjected to a data breach. Thus, you can get the benefits of Kroll Monitoring for free.

- Legitimacy: Kroll is a legitimate company that is trusted by Fortune 500 companies, government entities, and financial institutions.

Cons

- Lack of transparency: Kroll doesn’t specifically list what platforms it monitors and how, so it’s not certain how thorough its monitoring service is.

- Mixed reviews: Some people report a poor experience with customer service (though others report positive experiences). Mixed reviews might suggest inconsistency.

- Prior data breach: Kroll itself was subject to a 2023 data breach that led to a 2025 lawsuit, showing that even companies like Kroll can be susceptible.

- Short-term: Kroll Monitoring is designed to help restore your identity after a data breach, not prevent data breaches, making it a short-term solution but not a long-term identity protection service.

Alternatives to Kroll Monitoring

While Kroll Monitoring is a good short-term option for restoring your identity post-data breach, alternatives like LifeLock, Identity Guard, and Aura might be better for long-term, comprehensive protection. That’s because these alternative services are sold directly to customers and include additional features to help you stay safe online.

LifeLock

Offered by Norton, LifeLock features credit monitoring, stolen wallet protection, phone takeover monitoring, social media monitoring, home title monitoring, and related services with up to $3 million in coverage, depending on your plan. Pricing for individuals ranges from $11.99/mo. to $34.99/mo., while the Ultimate Plan for two adults costs $69.99/mo. Annual plans come with discounts, and you can add on other Norton services such as device security and a VPN.

Identity Guard

Identity Guard monitors the dark web, data brokers, credit cards, social media, and other sources for signs of fraud. If it detects suspicious activity, Identity Guard sends data breach alerts and puts you in contact with 24/7/365 fraud remediation agents. Perks include a password manager and $1 million in identity theft insurance coverage.

Identity Guard pricing ranges from $8.99/mo. to $29.99/mo. for individuals and $14.99/mo. to $39.99/mo. for families of up to five adults and unlimited children. Discounts are available for annual plans.

Aura

Aura offers a host of services under one subscription, including credit monitoring, identity theft protection, data broker removal, a VPN, antivirus software, spam call protection, password manager, safe gaming, and parental controls. Each adult also gets $1 million in identity theft coverage.

Aura pricing ranges from $15/mo. for one adult to $29/mo. for two adults to $50/mo. for five adults and unlimited children. Like the others listed here, discounts are available for annual plans.

How data broker removal prevents identity theft

Public data brokers, also known as people-search sites, collect your personal information from all sorts of public sources, combine it into so-called background reports, and publish it online for anyone to view. That makes people-search sites goldmines for scammers who can use the exposed private details to impersonate you, guess your passwords or answers to security questions, launch phishing and smishing attacks, and even break into your accounts to steal your identity or money.

Onerep safeguards your identity by automatically removing your personal information from 232 people-search sites, then monitoring to ensure they don’t republish it later. If they do, Onerep instantly restarts the removal process. This way, your private data isn’t available to identity thieves, vastly reducing your risk of being targeted in common identity theft and social engineering scams.

Final verdict: should you trust Kroll Monitoring?

If you’ve been offered Kroll Monitoring services for free after a data breach, we recommend enrolling for short-term protection and assistance in case your identity has been compromised. For ongoing, year-round identity theft protection with added perks, we suggest relying on alternative options.

FAQs

Should I give my SSN to Kroll?

If you received an official letter with an offer to enroll in free Kroll Monitoring services, it’s generally safe to give your Social Security number to Kroll. They need it to monitor for potential misuse of your SSN, and they protect it by encrypting data in transit and at rest. Just make sure you’re entering the SSN on the official Kroll page/ webform, not a phishing one.

Is Kroll legit?

Yes, Kroll is a legit company specializing in risk management. It has a global presence and is routinely trusted by Fortune 500 companies, governments, and financial institutions. If you received a letter explaining that your data might have been leaked in a breach and that the company in question has retained Kroll to provide identity monitoring and restoration services, it’s most likely legitimate.

What does Kroll Monitoring include?

Kroll Monitoring includes consultations with trained identity theft experts, monitoring for non-credit-based personally identifiable information, credit monitoring, instant alerts, and identity restoration services (if needed).

What do Kroll identity monitoring reviews say?

Kroll Monitoring reviews are mixed. One Kroll credit monitoring review might report an exceptional experience with quick, expert support, while another might state the exact opposite – poor customer service and a negative overall experience. On the one hand, Kroll has many negative reviews on platforms like BBB and Trustpilot. On the other hand, the number of reviews is only a small fraction compared to the total number of users the company has had over the years. While it’s not a reason to dismiss complaints, it might also indicate that the experience is uneventful for most users (hence no need to leave any review).

Did Kroll have a data breach?

Yes, in 2023 Kroll was the victim of its own data breach when a hacker used a sophisticated SIM-swapping tactic to take control of a Kroll employee’s phone and gain access to Kroll’s cloud. The hacker was able to access personal data and launch phishing attacks against customers FTX had hired Kroll to protect, leading a group of FTX customers to file a class-action lawsuit against Kroll in 2025.

Mark comes from a strong background in the identity theft protection and consumer credit world, having spent 4 years at Experian, including working on FreeCreditReport and ProtectMyID. He is frequently featured on various media outlets, including MarketWatch, Yahoo News, WTVC, CBS News, and others.